If you experienced the distressed sale of a home but now you have your credit and finances back in order, you may still be asking the question “How long do I have to wait to qualify for another mortgage.” Based on when you experienced your distressed sale, the length of time will differ. Each different […]

Category Archives: Home Buyer Tips

A Home Warranty Can Save Money

We are past April 15th, tax filing day. You already know what your expenses were for last year. Unfortunately, the money spent on home repairs is not deductible. But if you are aware of how much you spent, it could help you make decisions that will save you money this year. Buyers are often provided […]

Roll the Repairs into the Mortgage

Wait More Pay More

The “Right” Agent and the “Right” Home

Some potential home buyers determine which agent they will use when they start looking for their dream home. They believe that finding the home is the most critical part. While finding a home is critical, the most important part is getting good representation. Finding the right agent requires more skills then just being the agent […]

Remove PMI to Lower Your Expenses

Private mortgage insurance is usually required on mortgage loans for more than 80 percent loan-to-value. If a borrower defaults on their loan, mortgage insurance will reimburse the lender. You need to be aware that when certain conditions have been met, expensive PMI can be removed. When your mortgage balance has reached 80 percent of your […]

Benefits to Short Term Mortgages

Considering refinancing? Buying a new home? It maybe worth discussing a 15-year loan instead of a traditional 30-year mortgage. Monthly payments will be higher but your interest rate will be lower and your equity will climb faster. Below I have provided an example for comparison on a $300,000 mortgage with two terms. One 30-year term […]

Down Payment Problem – Are You Sure?

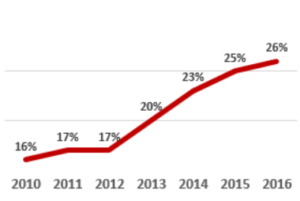

Each year the National Association of Realtors publishes the Home Buyers and Sellers Generational Trends Report. In their latest report, they state that although Millennials are becoming the largest home buying group (34%) they are facing the difficulties of rising rents, rising home prices, student loan debt and flat wages. Today’s would-be buyers feel they […]

Need a CLUE?

It has nothing to do with the table game where you search for a murderer, but you need to get a CLUE report. This report details the insurance claims submitted on your home and car over the past five to seven years. C.L.U.E stands for Comprehensive Loss Underwriting Exchange. CLUE is a database used by […]