If you experienced the distressed sale of a home but now you have your credit and finances back in order, you may still be asking the question “How long do I have to wait to qualify for another mortgage.” Based on when you experienced your distressed sale, the length of time will differ.

Each different lending authority will establish its own waiting period. You may have been current on all your payments and have a good history of credit, but you may qualify for one type of mortgage over the other even while you are waiting.

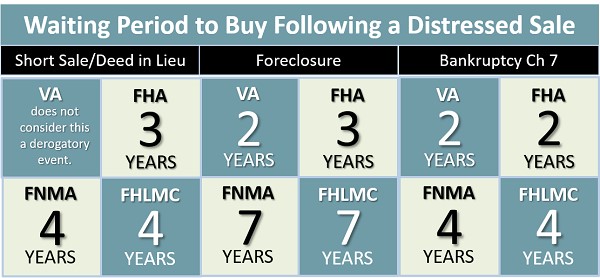

The following chart indicates how long a person might have to wait.

A recommended lender can make suggestions that will help you qualify for a mortgage and review and make suggestions based on your individual situation. You should start the process before you begin looking at homes so you will know what you qualify for and what the wait time will be for the current loan requirements. You may also have some extenuating circumstances that might affect your ability to get a loan. Remember, it is always better to be prequalified before making any offers.

We want to be your personal source of real estate information and we’re committed to helping from purchase to sale and all the years in between. Call us at (703) 303-4010 for lender recommendations.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!