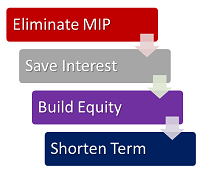

Here’s a tip for potential FHA buyers of Northern Virginia homes for sale: Paying extra principal on your mortgage loan can help you remove the required monthly mortgage interest premium (MIP) faster, which will lower your monthly loan payment, reduce your overall interest, and build equity faster on your home.

Category Archives: Fairfax & Northern VA Homebuyer Savings Strategies

Home Safety & Security Tips for Northern Virginia Home Owners

Rates Down, Prices Up – How Affordable is Housing in September 2012?

There is an interesting trend occurring this year – in Northern Virginia real estate and real estate markets throughout the country – and buyers need to be aware. There may be an explanation for why there is still not a huge sense of urgency to purchase a home now, even though mortgage rates remain extraordinarily low.

Determining the Value of Your Northern Virginia Home

The Northern Virginia real estate market has been heating up this summer, and loan interest rates have stayed low, so you may be considering buying a new home, refinancing or getting a home equity loan. In any of those situations, knowing the current value of your home is important. Home values are best determined by recent sales and the supply and demand of properties currently on the market.

The American Dream – Owning a Home Can Save You Money

When it comes to the American Dream of owning a home, nothing much has changed. People still want a place to call their own, to raise a family and feel secure. Homeownership also provides emotional and financial benefits. The American Dream in is still alive in the Northern Virginia real estate market and across the country!

Mortgage after Foreclosure, Short Sale, or Bankruptcy – How Long Do I Have to Wait

It is no longer unusual to meet someone in your area who has had a foreclosure, short sale or bankruptcy. The recession has taken a toll on home owners across the country, as well as owners of Northern Virginia real estate. The big question on these people’s minds is, “When will I be able to qualify for a mortgage loan again?” The answer varies, because it depends on the financial route that has been chosen.

Rules of Homeownership – Save Money and Increase Return on Investment

Most people agree that homeownership rules! Many people say they want a home they can call their own, to raise a family and to feel safe. Homes also account for a great part of most people’s net worth. During this rebounding market period in Northern Virginia real estate, more folks are again looking toward being home owners.

Dont Wait – Purchase Your Retirement Home Now And Save Big Money

With all of the opportunities to purchase great homes for sale in Northern Virginia, you may have been thinking about purchasing another property, maybe even one for your retirement. Even if you are not ready to move into it yet, purchasing a home to retire to now will give you the benefit of the current low interest rates, reduced prices and lower competition.