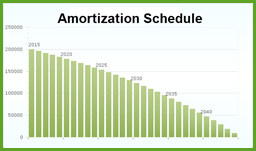

Amortization – this word is used to describe the accounting process by which most buyers will repay their home loans over time. Most home buyers will be set up with an amortized mortgage. The benefit to an amortized fixed-rate mortgage is that your payment will remain the same over the entire term of your home […]

Category Archives: Mortgages

How much do you want to pay?

A-Tisket, A-Tasket, put money in your basket

Save Interest, Build Equity & Shorten the Term

Investing in savings accounts today will earn you back less than one percent on your money and you will be required to pay income tax on those earnings. But if you contribute something extra to your mortgage each month, you will earn savings in a more beneficial way. Paying additional principal payments on your home […]

ARMs: Scary or Sensible?

Buying a Home in Burke During the Winter

If you’ve been thinking about buying a home in Burke, you’ve chosen well! Burke is a wonderful place to live. Offering tons of opportunities for outdoor recreation and top-notch education for the kids, Burke has received national attention as one of the best small cities to call home. You can’t go wrong with buying a […]

Another Refinancing Benefit

As a homeowner, you are probably familiar with the most popular reasons to refinance your home: building equity and saving loan interest. However, there is another reason to refinance that you might not have thought about which is removing someone from the loan. If or when there is a divorce case, and one of the […]

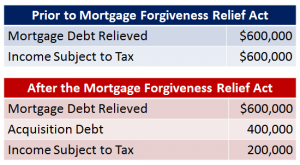

Are You Taking Advantage of Mortgage Interest Deduction?

The original intention of the 16th Amendment in 1913 was to allow a tax deduction on all interest a taxpayer might pay. Before World War One, businesses were the ones paying the most interest with individuals paying very little. Decades later with things such as revolving credit, credit cards, student loans and home equity loans […]