The original intention of the 16th Amendment in 1913 was to allow a tax deduction on all interest a taxpayer might pay. Before World War One, businesses were the ones paying the most interest with individuals paying very little. Decades later with things such as revolving credit, credit cards, student loans and home equity loans becoming more popular individuals paying interest increased as each of these entities would also charge interest.

The FHA or Federal Housing Authority was created in the 1930′s to help homebuyers finance their homes. Thus other semi-governmental agencies were created to facilitate mortgage lending such as FannieMae (FNMA), FreddieMac (FHLMC) and GinnieMae (GNMA).

Now Congress in their infinite wisdom never wanted this deduction used to encourage homeownership, but it inadvertently benefitted millions of would-be homeowners who could not pay cash for a home. Turns out this deduction has given millions of people the benefit of homeownership.

In 1986, the Tax Reform Act got rid of personal debt interest deductions, like credit cards and car loans, with the exception of interest debt on qualified mortgages. The Tax Reform Act introduced two new terms to define what “qualified” meant.

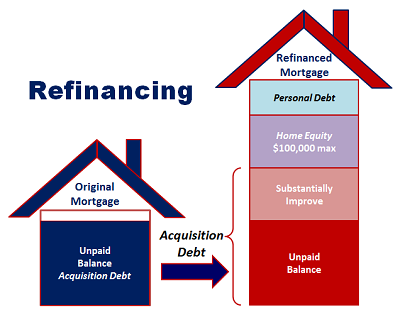

- First term, Acquisition Debt, is defined as the total amount of debt incurred less than $1M maximum used in buying, building or improving your principal residence or an allowed second home. The lien must be recorded. For this initial debt, you cannot have increased the amount by any refinancing. Acquisition Debt is the original loan amount which decreases through an amortization schedule.

- Second term, Home Equity Debt, is any loan amount up to $100K over and above your Acquisition Debt. This lien must also be recorded against your first or your second home. You can use the Home Equity Debt for any purpose since it is no longer restricted. Most homeowners use it for home improvement big ticket items such as a new roof, kitchen make over, or adding on livable space.

Below I am providing you a graphic example of a homebuyer who has borrowed money and that initial mortgage is classified “Acquisition Debt.” The recorded mortgage then becomes a balance which is reduced by the now homeowner making payments each month. Move ahead to the future after the home has increased in value, this same homeowner refinanced a larger amount to do some improvements or debt consolidation.

Thus, the existing amortized “Acquisition Debt” gets turned over into the new mortgage lien with any additional borrowed funds added also. The interest on this new “refinanced” mortgage is now tax deductible.

Once this new mortgage is recorded, the homeowner could also get a “Home Equity Debt” loan up to $100K maximum. Home Equity Debt loans are typically a percentage based on “Acquisition Debt” and the market value of the home. Don’t be surprised if a home appraisal is requested as a qualification for this kind of loan. Once these two deductible loan amounts have been satisfied, any amounts owed over and above this would be considered personal debt which is not tax deductible.

Warning: a mortgage lender is not worried about whether you can deduct your loan interest on your taxes or not. A lender just wants to make sure that the equity in the home is sufficient enough that if you go to foreclosure, they can get their money back on the sale of your home. I would suggest that you, as a homeowner, always consult a tax professional before making any of these major life changes to make sure that the loan interest will be tax deductible. Don’t get hung out to dry on paying non-deductible interest on personal debt for your home.