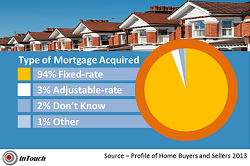

Over the last year about 94 percent of home buyers bought a home using a fixed-rate mortgage, taking advantage of the lowest rates in history. However, some of these buyers will be paying more in interest than they need to based on how long they will own their home.

Over the last year about 94 percent of home buyers bought a home using a fixed-rate mortgage, taking advantage of the lowest rates in history. However, some of these buyers will be paying more in interest than they need to based on how long they will own their home.

If you only plan to be in your home for a couple of years, an adjustable-rate mortgage (ARM) might be right for you and offer you savings.

During the initial period, the interest rate on your adjustable-rate mortgage will be lower than that of a fixed-rate and your home will amortize faster than at the higher fixed-rate interest.

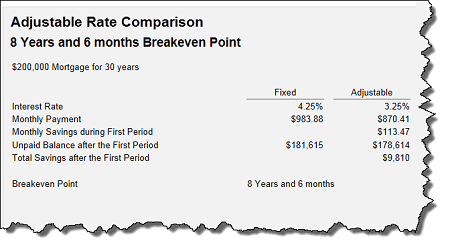

I have provided you with an example below that shows a $200,000 mortgage over 30 years compared using two methods; a 4.25 percent fixed-rate and a 3.25 percent 5/1 FHA adjustable rate or ARM. Over the first five years of the ARM, there is a $113.47 monthly savings which adds up to $6,808.20. Additionally, because the home will amortize faster with the lower interest rate, the unpaid balance will be $3,001 lower at the end of five years. So the ARM gives you a total savings of $9,801.

If we assume that an ARM is allowed to escalate at the maximum each period, you would break even on the purchase of the home in eight years and six months. If you had plans to sell the home at or before this time, an ARM would have provided you with a lower housing cost.

Some people don’t like the uncertainty of interest rates and how they behave, but if you are in a position where you know you will only be in a home for a shorter period and have good financial standing, an ARM might be right for you. I can provide you a list of Fairfax homes for sale to assist you in your decision.