Even if you have a property lost due to foreclosure or short sale and you might feel relief from being out from under your mortgage obligation, the cancelled amount must be included in your income tax reporting depending on circumstances. The amount you have to report can be a significant tax difference and therefore of serious concern to homeowners with homes for sale in Northern Virginia.

Even if you have a property lost due to foreclosure or short sale and you might feel relief from being out from under your mortgage obligation, the cancelled amount must be included in your income tax reporting depending on circumstances. The amount you have to report can be a significant tax difference and therefore of serious concern to homeowners with homes for sale in Northern Virginia.

The Mortgage Relief Act enacted by Congress is designed to specifically help homeowners affected during the housing crisis which began in 2007. Although the original Act expired on December 31, 2012, it was temporarily extended by Congress until December 31, 2013.

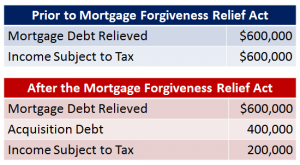

The Mortgage Relief Act applies to a taxpayers’ principal residence and does not include investment property or second homes. Maximum limits are $2 million of mortgage debt forgiveness or if filing separately, $1 million.

An additional provision states that the debt relief is limited to acquisition indebtedness used to buy, build or improve the property. It excludes any cash equity loans made separately or in conjunction with refinancing your original mortgage.

If facing the possibility of a foreclosure or short sale, I advise homeowners with homes for sale in Northern Virginia to seek expert advice from your legal and/or tax professional. Find out how it will affect your tax return if a portion of your mortgage is forgiven. As a reminder, the deadline is December 31, 2013. It will come faster than you think!