In the past twenty-five years, not many buyers have been assuming mortgages. In the late 1980’s, the Federal Housing Administration and the Veterans Administration began to require that buyers qualify for the mortgage assumptions. Most people think this is the reason for the lack of assumptions especially for homeowners with Fairfax homes for sale. It would certainly benefit certain buyers (low credit score buyers) by not having to qualify for a mortgage.

In the past twenty-five years, not many buyers have been assuming mortgages. In the late 1980’s, the Federal Housing Administration and the Veterans Administration began to require that buyers qualify for the mortgage assumptions. Most people think this is the reason for the lack of assumptions especially for homeowners with Fairfax homes for sale. It would certainly benefit certain buyers (low credit score buyers) by not having to qualify for a mortgage.

A homeowner who must qualify for an assumption as they would a new loan will generally choose the mortgage with the lowest interest rate. Rates have been trending down over the last twenty-five years, but it appears they have reached the bottom and will begin a gradual increase. Lower rates available on Federal Housing Administration and the Veterans Administration loans created in the last few years will appeal to buyers, even those who have to qualify for assumptions as interest rates rise.

If the current interest rate on a new loan is higher, government insured mortgages present significant advantages to buyers looking to assume a mortgage.

1. Assuming an existing mortgage that is further into its amortization schedule.

2. Higher interest rate loans do not amortize as fast as lower interest rate loans.

3. Assuming a mortgage has lower closing costs than generating a new mortgage.

4. Assumptions are easier to qualify for than a new mortgage loan.

5. An appraisal is not required.

There are some restrictions for Federal Housing Administration assumptions; they are only allowed for owner-occupied residents. Also, the buyer must meet current Federal Housing Administration guidelines for borrowers. The borrowers total debt ratio which includes house payment cannot exceed 41 percent of the borrowers’ monthly gross income. With buyer qualification, Veterans Administration loans are also assumable. However, for a veteran Seller to have their eligibility reinstated, the assuming buyer must also be a veteran with eligibility. Otherwise, the veteran forgoes his Veterans Administration loan eligibility for the life of the loan. Ask me any questions about being a Veterans Administration buyer or seller.

As little as a one percent rise in current rates can make a lower assumable mortgage begin to look very attractive. Assumptions may become more prevalent than they have been in the last 20 years as the differential becomes greater. Homeowners with Fairfax homes for sale may be more interested in offering assumptions in the near future.

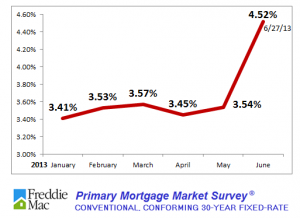

The graph to the right shows where mortgage rates were in late June.

The graph to the right shows where mortgage rates were in late June.