Whether you are a new home buyer or an experienced one, you don’t often buy the first home you view. Time is spent looking for the perfect home. Well why not apply that mentality to shopping for your mortgage. Don’t accept the first offer just because it is from your current bank.

Whether you are a new home buyer or an experienced one, you don’t often buy the first home you view. Time is spent looking for the perfect home. Well why not apply that mentality to shopping for your mortgage. Don’t accept the first offer just because it is from your current bank.

You may know that your credit background and the type of property you are buying will affect your loan rate, but don’t expect that all lenders will give you the same offer. Variables like your credit score, the home location, the price of the home, your down payment, the loan term you are requesting, the available interest rate will all affect what type of loan you can qualify for but not all lenders offer the same deal on the results.

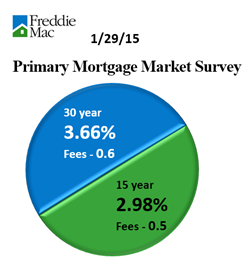

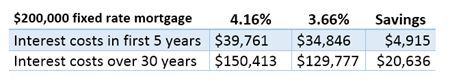

Taking the time to shop around and compare different offers from different lenders is a good exercise. By getting even a half percent lower rate, you will save on interest and monthly payment cost. In my example below, you can see what the difference in savings is between 4.16 percent and 3.66 percent rates.

While shopping for that loan, don’t worry about your credit score being checked multiple times. Credit bureaus take into account multiple requests being made from a variety of lenders during a short period of time.

If you are shopping for a loan, use my convenient mortgage calculator to see what difference a half percent will make. Plug in the years, interest rate, and total loan amount and if you know it even taxes and insurance cost to get a general idea of what your monthly payment will be. Or you can contact me and I will give you a list of my trusted mortgage professionals to interview.