According to the National Association of Realtor’s Aspiring Home Buyers 2017 profile, 59 percent of non-homeowners do not feel comfortable taking on a mortgage when they have student loan debt. Estimates claim that today’s college graduates average around $37,172 in student debt and that 39 percent of non-owners have student loan debt. Major player, Fannie […]

Category Archives: Home Buyer Tips

Don’t let Indecision Jack Up the Price of Your Home

Making a wrong decision is actually better for you than indecision. Home values and interest rates are heading up. It can be very expensive for you to wait on buying a home. Of course, you may have a legitimate reason to wait like improving your credit score or saving a down payment or even waiting […]

Would-be buyer to should-be buyer

Owning a home can be an emotional investment for some would-be buyers. They want to have a place to raise their family,enjoy gatherings and feel secure and safe. Other buyers may be more interested in lowering their costs of housing or building equity. No matter what your motivation is we can easily justify that now […]

What would you give to own a home?

Yogi Berra said he’d give his right arm to be ambidextrous. Most first-time home buyers would not do something so extreme to own a home but they are willing to make sacrifices. According to the National Association of REALTORS® 2016 Profile of Home Buyers and Sellers: 43% – cut spending nonessential items or luxury items […]

Relatives and Mortgage Loans – The Facts

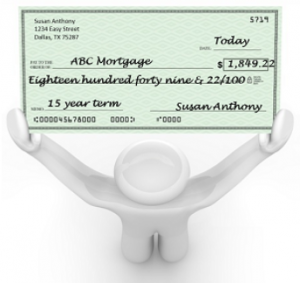

Don’t lose your ability to deduct mortgage interest from your taxes by not properly handling the mortgage loan paperwork when taking money from a relative to buy a home. Especially if you might become their heir. Home mortgage interest can only be deducted if the loan you accept is a secured debt and you sign […]

FOUND! Your Down Payment

It’s not far, if you know the way

If you’re going to play, GET IN THE GAME

Redfin recently conducted a survey of almost a 1000 home buyers where they stated that with inventory low, affordability is their number one concern. Competition from other buyers is getting stronger. But if you’re not in the game, then your chance of buying is even lower. Redfin’s survey showed that 26 percent choose affordability, 19 […]

Write Yourself a Check First

Is Understanding Costing You Money?

Most people including homeowners fear things they don’t understand. This fear leads people to not try different solutions that might be a benefit to them. Prospective buyers know about fixed rate mortgages and have long memories when it comes to stories about people losing their homes because they could not afford the payments once their […]