Owning a home can be an emotional investment for some would-be buyers. They want to have a place to raise their family,enjoy gatherings and feel secure and safe. Other buyers may be more interested in lowering their costs of housing or building equity.

Owning a home can be an emotional investment for some would-be buyers. They want to have a place to raise their family,enjoy gatherings and feel secure and safe. Other buyers may be more interested in lowering their costs of housing or building equity.

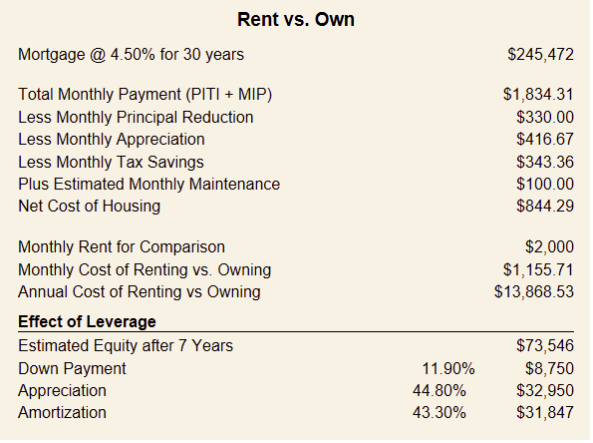

No matter what your motivation is we can easily justify that now is the time to buy a home. Here’s an example using an FHA loan and a home price of $250,000.

Your total monthly payment would be around $1,835.00. If this amount is lower than the amount of rent you are paying you need to keep investigating.

In my example, if we consider the reduction in monthly principal, appreciation per month, tax savings and some added money for maintenance each month, the net cost of your housing is still half the total house payment.

Taking into consideration all those advantages, a would-be buyer would-be spending over $1,100 a month more to rent than own. After a year, they would lose about $14,000 which is more that a required down payment of $8,750 for this price point.

Many would-be buyers know that a home is a big investment and may not understand that a low-down payment mortgage can give you leverage. The benefits extend beyond a return on the down payment but to the value of the home.

In my example below, the $8,750 down payment grows in equity of $73,546 in seven years based on 2 percent annual appreciation and normal loan amortization for a 30-year loan. If you calculated that as a rate of return, you’d be challenged to find anything that could compare with it.

To see what your numbers might look like, check out my Rent vs. Own graphic above. If you need any help or have any questions, contact me. Part of my greatest satisfaction is helping would-be buyers understand why they should-be buyers.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!