When purchasing a home, the largest expenditure you will have is the down payment. This payment can range from zero, if you are a veteran, to 3.5, 5, 10 and even 20 percent. When you get a mortgage, you will also get closing costs which will add another 2-4 percent that must be paid in […]

Category Archives: Buy a House

Buy Again, It’s Time

If you experienced the distressed sale of a home but now you have your credit and finances back in order, you may still be asking the question “How long do I have to wait to qualify for another mortgage.” Based on when you experienced your distressed sale, the length of time will differ. Each different […]

Remove PMI to Lower Your Expenses

Private mortgage insurance is usually required on mortgage loans for more than 80 percent loan-to-value. If a borrower defaults on their loan, mortgage insurance will reimburse the lender. You need to be aware that when certain conditions have been met, expensive PMI can be removed. When your mortgage balance has reached 80 percent of your […]

Benefits to Short Term Mortgages

Considering refinancing? Buying a new home? It maybe worth discussing a 15-year loan instead of a traditional 30-year mortgage. Monthly payments will be higher but your interest rate will be lower and your equity will climb faster. Below I have provided an example for comparison on a $300,000 mortgage with two terms. One 30-year term […]

It’s Your Advantage

Technology today is a wonder! We are able to do more things with our smartphones than we could just a few years ago. Homebuyers (over 90%) use video tours, digital signing and home search sites such as ZillowⓇ to get information about homes, neighborhoods, schools and even future neighbors. With all this technology happening, homebuyers […]

Real Cost of Housing

Over the last several years, there have been a variety of factors that have led to a rental unit shortage especially with single-family homes. Due to this shortage, rents nationwide have been increasing. In most national markets, it costs considerably less to own than to rent. Paying less on a monthly mortgage to buy a […]

What mortgage is best for me

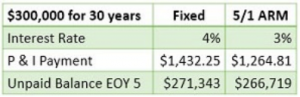

Mortgage rates are creeping up but are still pretty affordable. If you are looking to buy a home, there is an alternative to the fixed rate mortgage but you need to understand the rules. This alternative mortgage can significantly lower your cost of housing over the first five years. As an example, let’s take a […]

Waiting might cost you money…do you dare?

There is a frequently quoted expression “more money has been lost from indecision than was ever lost from making a bad decision.” Whether or not this statement is accurate, almost everyone can remember an incident when waiting cost them money. Real estate markets across the U.S. are short on inventory. Some so short that it […]

How much do you want to pay?

Conventional or FHA, which one should I pick?

First-time home buyers and repeat home buyers are often faced with determining which loan product they want to use. You have a certain amount of money you can use for a down payment, so should you go FHA or Conventional? Fannie Mae re-launched its Conventional 97% LTV conventional loan program in December 2014. Now the […]