Mortgage rates are creeping up but are still pretty affordable. If you are looking to buy a home, there is an alternative to the fixed rate mortgage but you need to understand the rules. This alternative mortgage can significantly lower your cost of housing over the first five years.

Mortgage rates are creeping up but are still pretty affordable. If you are looking to buy a home, there is an alternative to the fixed rate mortgage but you need to understand the rules. This alternative mortgage can significantly lower your cost of housing over the first five years.

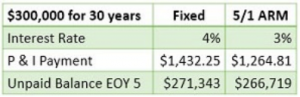

As an example, let’s take a $300,000 fixed-rate mortgage with a 4 percent rate which has a monthly payment of principal and interest of $1,432.25 for the full 30-year term. If you switch this with a 5/1 adjustable rate mortgage (ARM) at 3 percent it has a lower monthly payment for the first five years by $167.43. At the end of the five years the rate will adjust up or down based on a predetermined index.

Also interesting is that at the end of five years, the unpaid balance for the ARM is $4,624 lower than the fixed-rate mortgage. Your total savings in interest for those first five years with the ARM is $14,669.00.

This might sound really good, but ARMs are not the right choice for all buyers. It might be a really good choice if you want to buy a Fairfax home for sale and only plan to stay in the home a short time like 5 years or less. But it is something to consider.

I can refer you to a trusted mortgage professional who can help you to understand the advantages and disadvantages of an ARM based on your situation. You need the facts to make an informed decision.

Want some Insider Information on Fairfax homes for sale ? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or get a FREE Listingbook Account so you can Search All Northern Virginia Homes For Sale just like a Realtor. Put that data you need at the tips of your fingers!

Mortgage rates are creeping up but are still pretty affordable. If you are looking to buy a home, there is an alternative to the fixed rate mortgage but you need to understand the rules. This alternative mortgage can significantly lower your cost of housing over the first five years.

As an example, let’s take a $300,000 fixed-rate mortgage with a 4 percent rate which has a monthly payment of principal and interest of $1,432.25 for the full 30-year term. If you switch this with a 5/1 adjustable rate mortgage (ARM) at 3 percent it has a lower monthly payment for the first five years by $167.43. At the end of the five years the rate will adjust up or down based on a predetermined index.

Also interesting is that at the end of five years, the unpaid balance for the ARM is $4,624 lower than the fixed-rate mortgage. Your total savings in interest for those first five years with the ARM is $14,669.00.

This might sound really good, but ARMs are not the right choice for all buyers. It might be a really good choice if you want to buy a Fairfax home for sale and only plan to stay in the home a short time like 5 years or less. But it is something to consider.

I can refer you to a trusted mortgage professional who can help you to understand the advantages and disadvantages of an ARM based on your situation. You need the facts to make an informed decision.

Want some Insider Information on Fairfax homes for sale ? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or get a FREE Listingbook Account so you can Search All Northern Virginia Homes For Sale just like a Realtor. Put that data you need at the tips of your fingers!