First-time home buyers and repeat home buyers are often faced with determining which loan product they want to use. You have a certain amount of money you can use for a down payment, so should you go FHA or Conventional? Fannie Mae re-launched its Conventional 97% LTV conventional loan program in December 2014. Now the choice is even more confusing.

First-time home buyers and repeat home buyers are often faced with determining which loan product they want to use. You have a certain amount of money you can use for a down payment, so should you go FHA or Conventional? Fannie Mae re-launched its Conventional 97% LTV conventional loan program in December 2014. Now the choice is even more confusing.

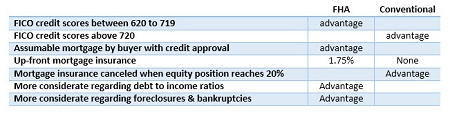

Fees for these two loan programs will differ greatly. The FHA loan product charges you an up-front mortgage insurance charge of 1.75 percent which is in addition to the recently lowered (by .5 percent) monthly mortgage insurance (MI) charge.

Another point, on an FHA loan the mortgage insurance is a fixed amount. For conventional loans, individual company rates and your credit score will determine the MI providers’ fees. The better your credit score the lower your fees and vice versa.

On the other hand, for conventional loans, MI can be cancelled once the equity of your property reaches 20 percent. MI through FHA is typically paid for the life of the mortgage. If you have an FHA loan and want to eliminate the MI it would mean refinancing your home with a conventional loan. This eliminates the MI but you are not able to deduct the up-front fee added to the mortgage or paid at closing. Check out my graphic below for a quick reference on the advantages to each type of loan product.

If your credit score is low, seeking out an FHA loan product might be a better solution. Conventional loan underwriters usually have a higher minimum credit score. FHA loan products are often more lenient when a borrower’s total monthly debt exceeds the customary 45 percent of their monthly income. Another benefit is that FHA allows shorter recovery time frames after you have had a bankruptcy or foreclosure.

As mentioned earlier, FHA introduced back in December 2014, a low-down payment program called Conventional 97% LTV. It is Fannie Mae backed and allows for a 3 percent down payment, very low MI rates and a 100% gift from blood or by-marriage relatives. The guidelines are less restrictive and simpler. If you are struggling, this may be the product for you.

But the overall decision-making factor is which of these loan products is best for you. Which will get you into your home with the lowest cost and fees. This often requires knowledge of the lending market that you and I don’t typically posses or inside information that we just aren’t privy to.

I can help you get access to all this information by referring you to one of my trusted mortgage professionals. I have been in business for many years and have built a repertoire of professionals. Contact me today for a referral!

And if you are in the market to buy and need a list of Fairfax homes for sale, let me know. I can find you homes that are FHA or Conventional loan eligible so you will have more options.