American homeowners have a record amount of equity in their home. Many of these homeowners would like to cash out part of that equity but don’t want to trade an historically low interest rate for one that is as high as it’s been in 20 years. Instead of refinancing their home, an option is to […]

Tag Archives: Fairfax Loan Modification

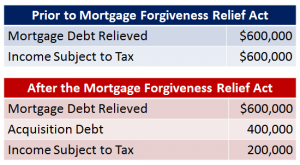

Debt Relief = Income

Cut Refinancing Expenses

Remove FHA Mortgage Insurance Premium

Home Mortgage Interest Deduction

Thoughts and choices If you are trying to decide to take standard tax deduction or itemize when filing your income tax return, you need to look at what gives you the highest return. Most people that make over $75,000 a year itemize their deductions, but with lower interest rates is this wise? For […]

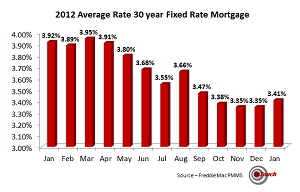

Should You Refinance?

FHA Changes – Higher Costs to You – Northern Virginia Real Estate

Fairfax Short Sales: Are You A Casualty Of The Terrible Loan Modification Process?

Fairfax VA – I recently saw an amusing video about loan modifications. In it the guy called Wells Fargo “Hells Fargo.” Evidently, it can sometimes be difficult to get a loan modification because they’ll often lose your paperwork. You have to talk to people in other countries where English IS NOT their first language. The […]

Fairfax Short Sales: Bank of America forecloses on paid off house

Fairfax VA – A recent article in the Sun Sentinel described a situation in which Bank of America foreclosed on a paid off home. Here’s an excerpt: When Jason Grodensky bought his modest Fort Lauderdale home in December, he paid cash. But seven months later, he was surprised to learn that Bank of America had […]

How can I short sale when my lender was so mean to me?

Fairfax VA -Debt collectors have a tendency to get pretty mean when someone gets behind on their payments. The constant barrage of threats, demands, and phone calls can become really overwhelming – leading many people to simply give up. Debt collectors have a difficult job, which is probably why they’re so mean. Still, I have […]