Mortgage lenders are constantly bombarding us to refinance our mortgage under a variety of different programs. The amount of offers can almost make you numb to the rational consideration.

The common rules of thumbs that homeowners and agents like to refer to such as not refinancing more often than at two year intervals or you must gain at least 2% savings from your previous mortgage rate may not always be accurate.

The reality is that if you’ll be in your home long enough to recoup the cost of refinancing and if you can get a lower rate, it should be considered. The costs incurred from previous refinancing that haven’t been recaptured by monthly savings may need to be added to the costs of the new refinance. With the reduction of available inventory in Fairfax VA Homes for Sale, some are considering staying where they are and just refinancing.

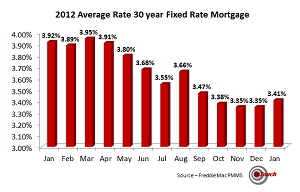

The chart shows the average mortgage rates for 2012 according to Freddie Mac. Rates are lower now than they were in January of 2012 and for the previous ten years.

Freddie Mac. Rates are lower now than they were in January of 2012 and for the previous ten years.

If you are going to be in your home for a long time, then refinancing may save you a substantial amount of money. The longer you live in the home, the more “savings” you receive. It is definitely worth investigating. Many people with Fairfax VA homes for sale may also be considering refinancing.

For a FREE report on CD of the 10 Best ‘Insider’ Home Selling Strategies that I extracted from over 8 years on my Real Estate Radio Show interviewing the Industry’s Top Experts.

Get my FREE report on CD of the Top 10 Insider Home Buying Secrets of the Wealthy on How to Save $25,000 to $50,000. We use these same proven strategies every day.