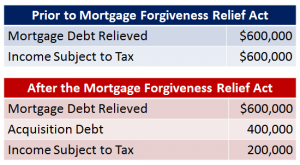

Even if you have a property lost due to foreclosure or short sale and you might feel relief from being out from under your mortgage obligation, the cancelled amount must be included in your income tax reporting depending on circumstances.

Tag Archives: Avoid Foreclosure

Save Money on Your Taxes by Bunching

Having low mortgage interest rates can be a drawback if the total interest and property taxes paid are below the amount paid for a standard deduction. If you plan a little you may be able to improve your situation at least every other year. Anyone that keeps tabs on their taxes knows that you can […]

Home Mortgage Interest Deduction

Thoughts and choices If you are trying to decide to take standard tax deduction or itemize when filing your income tax return, you need to look at what gives you the highest return. Most people that make over $75,000 a year itemize their deductions, but with lower interest rates is this wise? For […]

Mortgage after Foreclosure, Short Sale, or Bankruptcy – How Long Do I Have to Wait

It is no longer unusual to meet someone in your area who has had a foreclosure, short sale or bankruptcy. The recession has taken a toll on home owners across the country, as well as owners of Northern Virginia real estate. The big question on these people’s minds is, “When will I be able to qualify for a mortgage loan again?” The answer varies, because it depends on the financial route that has been chosen.

Fairfax Short Sales: Bank of America forecloses on paid off house

Fairfax VA – A recent article in the Sun Sentinel described a situation in which Bank of America foreclosed on a paid off home. Here’s an excerpt: When Jason Grodensky bought his modest Fort Lauderdale home in December, he paid cash. But seven months later, he was surprised to learn that Bank of America had […]