“Anyone may arrange his affairs so that his taxes shall be as low as possible…” While Judge Learned Hand was talking about federal income taxes, it can be applied to property taxes as well. Property valuation determination by the state or county is based on a number of variables such as size, amenities, location and […]

You Need Some Leverage

Leverage can give you an advantage whether you are lifting a heavy object or happen to be building up equity in a home. On a home, your loan-to-value mortgage allows you greater profits than just recovering your cash down payment. You can purchase a $250,000 home with an FHA loan making a 3.5 percent down […]

The Digital Age is Here

Write Yourself a Check First

Homeowner Check Up

You make an annual wellness visit to your doctor, why not make an annual review of your finances and your home investment. This is the last year to take advantage of the HARP program since it expires December 31, 2016. Your home is not only your largest investment but your biggest asset. Are you making […]

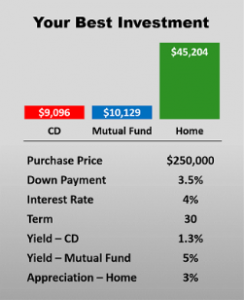

Are you making the right investment

Hey, your scratch-off ticket hits big and you win $8,750. Instead of spending it away, you decide to invest the money. Three alternatives are on your mind: purchase a certificate of deposit, invest in a mutual fund or use it as a down payment on a $250,000 home. Let’s compare these three alternatives by looking […]

Is Understanding Costing You Money?

Most people including homeowners fear things they don’t understand. This fear leads people to not try different solutions that might be a benefit to them. Prospective buyers know about fixed rate mortgages and have long memories when it comes to stories about people losing their homes because they could not afford the payments once their […]

Ewww That Smell…Can you smell that smell?

Homeowners can develop a condition that is called “nose blind.” Getting to this state involves three steps. The first is odor adaptation; your nose’s physical response that normalizes new smells. The second is odor habituation; a built-in reprogramming of our brain to ignore a smell. And last odor infestation which is what your guests smell […]

Remember to Get Your Annual Credit Report

Federal law now entitles you to receive a FREE copy of your credit report each year from the three credit bureaus: Experian, Equifax and TransUnion. These reports will alert you to any errors and update you on your creditworthiness. It is recommended that you stagger your request for these reports throughout the year. That way […]

It’s Your Advantage

Technology today is a wonder! We are able to do more things with our smartphones than we could just a few years ago. Homebuyers (over 90%) use video tours, digital signing and home search sites such as ZillowⓇ to get information about homes, neighborhoods, schools and even future neighbors. With all this technology happening, homebuyers […]