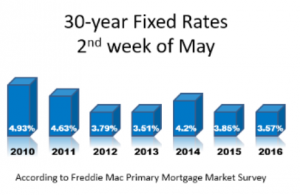

Of 50 million homeowners it is estimated that 7 million of them could save money each month if they refinanced their existing mortgage. One obvious saving is refinancing at a lower mortgage rate. Another saving is that if you bought a home before 2011 and your are paying for mortgage insurance, you might want to […]

Category Archives: Homeowner Tips

Some improvements keep on taking

Worth your time

“Anyone may arrange his affairs so that his taxes shall be as low as possible…” While Judge Learned Hand was talking about federal income taxes, it can be applied to property taxes as well. Property valuation determination by the state or county is based on a number of variables such as size, amenities, location and […]

Write Yourself a Check First

Homeowner Check Up

You make an annual wellness visit to your doctor, why not make an annual review of your finances and your home investment. This is the last year to take advantage of the HARP program since it expires December 31, 2016. Your home is not only your largest investment but your biggest asset. Are you making […]

Ewww That Smell…Can you smell that smell?

Homeowners can develop a condition that is called “nose blind.” Getting to this state involves three steps. The first is odor adaptation; your nose’s physical response that normalizes new smells. The second is odor habituation; a built-in reprogramming of our brain to ignore a smell. And last odor infestation which is what your guests smell […]

Remember to Get Your Annual Credit Report

Federal law now entitles you to receive a FREE copy of your credit report each year from the three credit bureaus: Experian, Equifax and TransUnion. These reports will alert you to any errors and update you on your creditworthiness. It is recommended that you stagger your request for these reports throughout the year. That way […]

Burning both ends earns benefits

There is a popular saying “burning the candle at both ends” which we often determine to mean being an A+ personality and working harder than the average person. But what if burning both ends gives you an unexpected benefit? Let’s use the analogy that the candle is your home mortgage and getting it paid off […]

Be ready for any emergency with this kit

Unexpected things can happen at any time, that’s why we call them emergencies. The Federal Emergency Management Agency or FEMA makes a standard recommendation to all Americans that you have enough basic supplies on hand to survive an emergency for at least three days. The creation of a “Ready” kit needs to be assembled now. […]

More Equity…More Options

If you are a homeowner, you should know that having equity in your home gives you options. The difference between the value of your home and what you owe on the home is called equity. During the recent “Great Recession” homeowner equity decreased nationwide. When the value of your home is less that the mortgage […]