If you experienced the distressed sale of a home but now you have your credit and finances back in order, you may still be asking the question “How long do I have to wait to qualify for another mortgage.” Based on when you experienced your distressed sale, the length of time will differ. Each different […]

Category Archives: Home Buyers

Roll the Repairs into the Mortgage

Wait More Pay More

Outlook 2018 Good

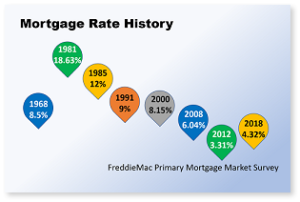

Historical Perspective

Back in 1968, mortgage rates were 8.5 percent. Then the following year, rates dropped to 7 percent. Homebuyers were able to buy a 15 to 20 percent larger home with the same payment if they could get their mortgage assumed. Back then FHA and VA mortgages were very popular for certain price ranges and these […]

The “Right” Agent and the “Right” Home

Some potential home buyers determine which agent they will use when they start looking for their dream home. They believe that finding the home is the most critical part. While finding a home is critical, the most important part is getting good representation. Finding the right agent requires more skills then just being the agent […]

Remove PMI to Lower Your Expenses

Private mortgage insurance is usually required on mortgage loans for more than 80 percent loan-to-value. If a borrower defaults on their loan, mortgage insurance will reimburse the lender. You need to be aware that when certain conditions have been met, expensive PMI can be removed. When your mortgage balance has reached 80 percent of your […]

A Good Option in FHA

A sector of the market that is not necessarily being met by other loan programs is being served by FHA insured mortgages. Buyers would love to secure a conventional 80 percent mortgage without mortgage insurance and get the lowest cost of financing possible, but if they can’t put down 20 percent then it isn’t really […]

Benefits to Short Term Mortgages

Considering refinancing? Buying a new home? It maybe worth discussing a 15-year loan instead of a traditional 30-year mortgage. Monthly payments will be higher but your interest rate will be lower and your equity will climb faster. Below I have provided an example for comparison on a $300,000 mortgage with two terms. One 30-year term […]