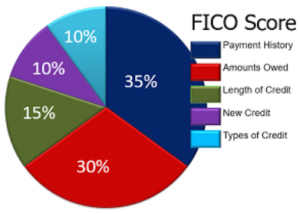

Lenders use credit scores to measure a borrower’s creditworthiness. Although several different companies offer credit scores, the Fair Isaacson Corporation or FICO is the one that is most often used. FICO uses five key components to determine a borrower’s overall credit score or rating. The highest percentage, 35 percent, is judged on payment history which […]

Category Archives: Home Buyers

Buy Now or Wait?

It is surprising the number of people who contact a RealtorⓇ or real estate office with intentions on buying a home but they can’t qualify for a loan or don’t have a down payment. Sometimes a RealtorⓇ will begin working with a buyer who has the down payment and good credit but decides to postpone […]

You Need Some Leverage

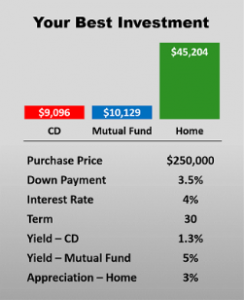

Leverage can give you an advantage whether you are lifting a heavy object or happen to be building up equity in a home. On a home, your loan-to-value mortgage allows you greater profits than just recovering your cash down payment. You can purchase a $250,000 home with an FHA loan making a 3.5 percent down […]

Are you making the right investment

Hey, your scratch-off ticket hits big and you win $8,750. Instead of spending it away, you decide to invest the money. Three alternatives are on your mind: purchase a certificate of deposit, invest in a mutual fund or use it as a down payment on a $250,000 home. Let’s compare these three alternatives by looking […]

It’s Your Advantage

Technology today is a wonder! We are able to do more things with our smartphones than we could just a few years ago. Homebuyers (over 90%) use video tours, digital signing and home search sites such as ZillowⓇ to get information about homes, neighborhoods, schools and even future neighbors. With all this technology happening, homebuyers […]

Forced Savings

Your bank may have a voluntary program where you can transfer $100 each month from checking to savings. After five years, you would have over $5,000 in your savings. You can view this as a type of forced savings. The same happens when you buy a home with a standard amortizing mortgage. Each month as […]

Real Cost of Housing

Over the last several years, there have been a variety of factors that have led to a rental unit shortage especially with single-family homes. Due to this shortage, rents nationwide have been increasing. In most national markets, it costs considerably less to own than to rent. Paying less on a monthly mortgage to buy a […]

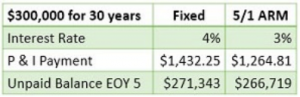

What mortgage is best for me

Mortgage rates are creeping up but are still pretty affordable. If you are looking to buy a home, there is an alternative to the fixed rate mortgage but you need to understand the rules. This alternative mortgage can significantly lower your cost of housing over the first five years. As an example, let’s take a […]

Waiting might cost you money…do you dare?

There is a frequently quoted expression “more money has been lost from indecision than was ever lost from making a bad decision.” Whether or not this statement is accurate, almost everyone can remember an incident when waiting cost them money. Real estate markets across the U.S. are short on inventory. Some so short that it […]

A Champion on Your Side

In sports, we have the World Series and the Super Bowl to determine baseball and football champions. As with any competition there can be only one champion, one winner, one loser. Throughout history, kings would have knights to be their champions and the knights would fight for various reasons. Today, buying or selling a home […]