Taking the time to save a down payment for buying a home might be keeping you from actually buying a home. But you may be unaware that those funds may already exist. NAR does a Profile of Home Buyers and Sellers report each year which says that 81 percent of first-time buyers pull all or […]

Category Archives: First Time Home Buyers

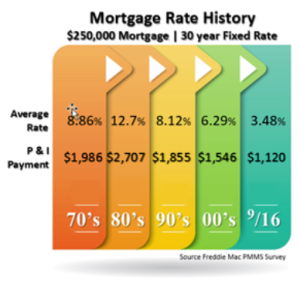

It’s a Fact, Interest Rates will Rise

“If” interest rates go up is not the correct question. “When” interest rates go up is what you need to worry about. Because “when” those rates increase it will be a big difference for buyers and move-up buyers. Freddie Mac is predicting that mortgage rates will be at 4.5 percent a year from now. Higher […]

Waiting on your dream home…Why?

Some buyers are under the impression that they need to wait until they have saved a 20% down payment so when they buy their dream home they can avoid mortgage insurance (PMI) which lenders required when the loan-to-value ratio of larger than 80 percent. The only exception to this rule is VA loans. Here is […]

Let your retirement fund your home purchase

How much do you want to pay?

Conventional or FHA, which one should I pick?

First-time home buyers and repeat home buyers are often faced with determining which loan product they want to use. You have a certain amount of money you can use for a down payment, so should you go FHA or Conventional? Fannie Mae re-launched its Conventional 97% LTV conventional loan program in December 2014. Now the […]

Local Money or Internet Money? That is the Question

Can you afford to pass on this opportunity?

Are You Ready for This?

A short story about an offer presented to a single, senior woman who was relocating to a retirement home: The offer was for full price and had reasonable terms and timelines. The seller would not accept it. As the offering agent delved deeper into why, the agent discovered the seller was upset about her dining […]

A Down Payment Source to Consider

Most of us know that if you withdraw funds early from your IRA you pay a 10 percent penalty. Current withdrawal age is 59.5 years old. But first-time homebuyers have an exception available to them. They are allowed to withdraw up to $10,000 per person, penalty free, if they did not own a home in […]