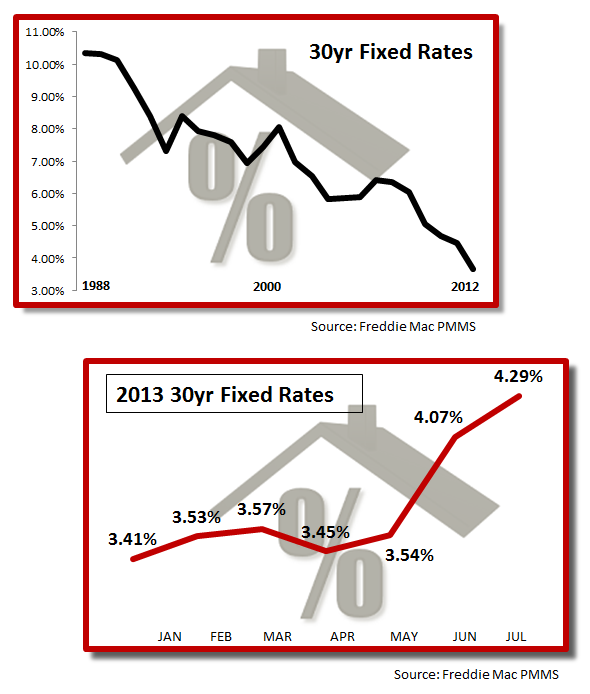

Housing affordability is a concern for would-be homeowners with interest rates and home prices on the rise. If you are renewing your certificate of deposit, rising interest rates are great, but not when you are borrowing money.

All posts by Thierry Roche

Federal Housing Administration & Veterans Administration Mortgage Assumptions

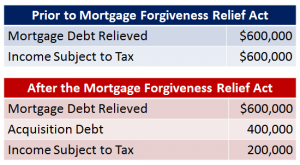

Debt Relief = Income

Get Your Offer Accepted

With dramatically shrinking inventory, many real estate markets are now experiencing multiple offers on a home. It is a benefit for sellers with homes for sale in Northern Virginia, who prefer to be able to pick the best offer for them, but it’s frustrating for buyers. As a buyer, you may consider the following tips to get your offer accepted.

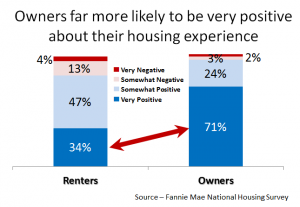

Renters Want to Buy

In a recently released study, Fannie Mae states the consumer attitudes continue to be favorable about homeownership, especially with younger generations, ages 18 to 34. When comparing the financial and lifestyle benefits, slightly over half of them (71 percent) think that owning makes more sense than renting. Protection against rent increases was mentioned.

Report: U.S. Home Prices on the Rise

Much to the elation of anyone with a Fairfax VA home for sale or sellers anywhere, home prices are on the rise in nearly all states, according to a recent report from the real estate researcher CoreLogic. Evidently, 48 states showed year-over-year gains in April. Meanwhile, home prices also showed month-over-month gains between March and April. […]