Owning a home can be an emotional investment for some would-be buyers. They want to have a place to raise their family,enjoy gatherings and feel secure and safe. Other buyers may be more interested in lowering their costs of housing or building equity. No matter what your motivation is we can easily justify that now […]

All posts by Thierry Roche

Deduct Your Interest and Lower Your Rate

America’s credit card debt is back and at levels we saw prior to the recent recession. According to CreditCards.com Weekly Credit Card Report, APR’s are running just under 16 percent. But homeowners have an advantage that renters do not when it comes to dealing with high debt. Debt advisors will tell you that you need […]

Rental properties are IDEAL investments

Offering a higher rate of return than other common investments without the volatility of the stock market are IDEAL rental homes. The latest rates on certificates of deposit (CDs) is under 2.5% and the latest bond rates are all under 1.5% unless you go really long term and you may get 3%. But with CDs […]

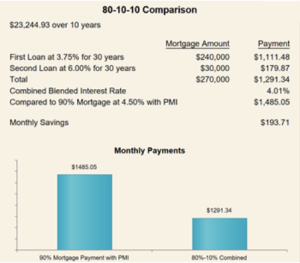

Save the Cost of Mortgage Insurance

The Great Recession included a banking crisis and in turn mortgage products were streamlined and others were taken off the table. With the return of the economy, previously unavailable mortgage products are now being offered. One of those products is called the “Piggyback” or the 80-10-10 mortgage and it can save you a lot of […]

Estate Planning – Don’t put it off!

You need estate planning! In the event of your death or incapacitation, these documents will be used by your executor(s) to make decisions for you. Your surviving spouse, adult children, minor children, property and your investments will all be factors for decision making and will only benefit if you get it done. Will – used […]

Tax Benefits of Home Ownership

In 1913, the 16th amendment introduced personal income tax and U.S. taxpayers have enjoyed specific tax benefits for home ownership. These tax benefits may not be the reason why most people buy a home, but they are real and are not available to people who rent. Changes made to the capital gains tax code in […]

Teaser Rates are Not Available for All Buyers

Lenders and Mortgage companies will often publish “teaser” rates to draw buyers but these rates are not always available to all buyers. Let’s review a sample situation. Suppose a monthly loan payment for an advertised rate convinced you to make an offer on a home for sale. And then after you negotiated and signed a […]

Reasons to buy into the rental market

Some characteristics to owning a single-family home are not available through standard investment types. Single-family homes give an investor the opportunity to borrow large loan-to-value amounts with fixed rates for long terms on assets that keep appreciating. They also offer tax advantages and a reasonable amount of control. On most residential units up to four […]

What would you give to own a home?

Yogi Berra said he’d give his right arm to be ambidextrous. Most first-time home buyers would not do something so extreme to own a home but they are willing to make sacrifices. According to the National Association of REALTORS® 2016 Profile of Home Buyers and Sellers: 43% – cut spending nonessential items or luxury items […]

Relatives and Mortgage Loans – The Facts

Don’t lose your ability to deduct mortgage interest from your taxes by not properly handling the mortgage loan paperwork when taking money from a relative to buy a home. Especially if you might become their heir. Home mortgage interest can only be deducted if the loan you accept is a secured debt and you sign […]