Ever seen something on sale on a website? Sometimes, shopping online can really get you some great deals! And, maybe you see that item, you’re interested, but there isn’t really that full sense of urgency. Maybe there are other things going on in your life and you just didn’t get back to that item for a few days. Then, when you do go back to that website, the item is now back to it’s regular price. The sale is over.

How did that make you feel? Did you maybe pay full price? Were you disappointed in yourself for not acting quickly, save money, and had the product quicker?

That type of scenario make me think of home sales throughout 2021. In 2021, homes across the United State went up 19.1% on average. There were some markets where the prices soared 30 to 40%. Fortunately, last year the mortgage rates did remain relatively stable but that isn’t the situation this year, in 2022.

It’s quite known here in the real estate world that there is quite a shortage of a housing inventory. While the number of sales did decline at the end of February 2022 to 7.2% month-over-month and 2.4% year-over-year, that could be explained as a lack of houses for sale. In the same month, inventory was 1.7 months which is down from 2 months in February 2021. The median sales price had a year over year increase of 15.0% to $357,300.

It really is a guessing game at this point on where rates are going to end a year from now. Many experts do believe that the decade of low rates is over, and we more than likely will not see them again.

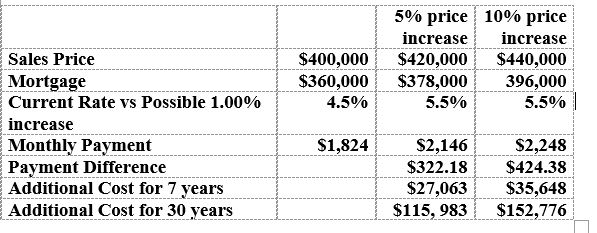

As you can well imagine, there’s an urgency to buy before the rates get higher. If a buyer waits for a year to purchase a home, and the price goes up by 5%, the interest rate goes up. And that will have a quite dramatic effect on the mortgage payment.

The equity in a person’s home contributes greatly to their overall net worth and wealth position. The effect is very apparent in contrast to renters compared to homeowners whose net worth is 1/40th of the homeowners $300,000 or $8,000 for the renters.

There are many homeowners who are trying to step into larger homes. In those cases, they meet their increasing demands of having a nicer home, and the equity will continue to grow based on two dynamics: appreciation and equity-build up. Renters do not benefit from either of these advantages.

Want to run your own comparison on today’s market, using your own numbers? Go to Cost of Waiting to Buy. If you haven’t developed a plan to purchase in today’s market whether it be your first home or a move-up, you need facts and a trusted team of professionals to work for you.

It starts with finding an agent who will be as committed to find your home as you are. I would love to help you or your friends. It is what I do.

I can provide Insider Information on Fairfax VA homes for sale. Get you a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!