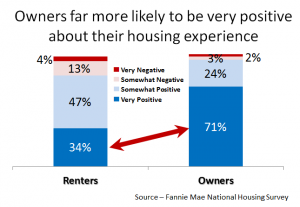

In a recently released study, Fannie Mae states the consumer attitudes continue to be favorable about homeownership, especially with younger generations, ages 18 to 34. When comparing the financial and lifestyle benefits, slightly over half of them (71 percent) think that owning makes more sense than renting. Protection against rent increases was mentioned.

Tag Archives: Northern Virginia Homebuyers

Remove FHA Mortgage Insurance Premium

FHA Loans and Mortgage Insurance Premium – More Expensive than Expected

Federal Housing Administration (FHA) loans can be confusing because the FHA does not make loans. It insures the loans made by lenders it has approved. So, if a lender defaults, the FHA covers the losses – not the lender.

One of the great benefits of an FHA insured loan is that it only requires a 3.5% down payment, making homeownership much more feasible for those potential buyers purchasing Fairfax VA Real Estate, who do not have the traditional 10%-20% down that conventional mortgages require.

Readying your home and life to leave on vacation

Fairfax, Va Real Estate – It’s a great time to buy!

The term Fiscal Cliff has become a commonly used term, but most of us don’t know what it means and how it applies to Real Estate. Simply, it refers to sweeping tax cuts enacted a decade ago that were set to expire at year’s end. For real estate, it had the potential to derail the recovery that’s been slowly taking hold. Foreclosures would rise and home values would drop.

The uncertainty of what would happen if the Fiscal Cliff bill did not pass, had potential home buyers and sellers holding back on making a transaction

But, the recent legislation passed by Congress and signed by the President, makes Northern Virginia Real Estate a good investment.

Smart Buyer Tips – Northern Virginia Real Estate 2013

If you have been shopping for Fairfax, Va real estate recently, you may notice prices are rising again, and competition for homes has started heating up. A “sellers market” may be where you find yourself as a buyer if you are looking at homes for sale in Northern Virginia.

As the market shifts from a buyer’s market, it’s good to know how to improve your chances to have the seller accept your offer. The secret to finding the best home at the best price is knowing how to present your offer in this changing market.

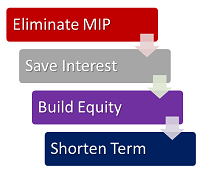

Cut the Costs of FHA Loans – Eliminate Your MIP

Here’s a tip for potential FHA buyers of Northern Virginia homes for sale: Paying extra principal on your mortgage loan can help you remove the required monthly mortgage interest premium (MIP) faster, which will lower your monthly loan payment, reduce your overall interest, and build equity faster on your home.

Rules of Homeownership – Save Money and Increase Return on Investment

Most people agree that homeownership rules! Many people say they want a home they can call their own, to raise a family and to feel safe. Homes also account for a great part of most people’s net worth. During this rebounding market period in Northern Virginia real estate, more folks are again looking toward being home owners.