Parents! Do you have children getting ready to go to college either this year or shortly thereafter? The average cost of the 2015-16 school year is $32,405 for a private college, $9,410 for state resident of a public college and $23,893 for out-of-state residents. If you had begun a college savings account when your child […]

All posts by Thierry Roche

Investment Alternative

A natural investment alternative for you as a homeowner is rental homes. Because you already own a home and are familiar with them, you realize that the maintenance on a rental home is not that different from your own home. You can use the same painters, plumbers and other contractors that you use on your […]

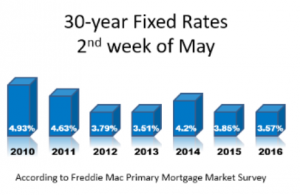

Are you one of the 7 out of 50 that will save money

Of 50 million homeowners it is estimated that 7 million of them could save money each month if they refinanced their existing mortgage. One obvious saving is refinancing at a lower mortgage rate. Another saving is that if you bought a home before 2011 and your are paying for mortgage insurance, you might want to […]

Some improvements keep on taking

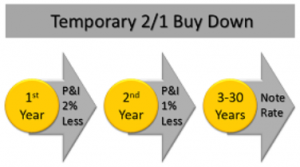

Little Known Buyer Incentive

An available solution for helping buyers and sellers is this uncommon mortgage program. Called a temporary buy down, it is a fixed mortgage in which to seller prepays the interest at closing i order to lower the payments for several years. The borrower must be approved at the note rate however, but will get the […]

What you need to know about buying rentals

The decision to buy rental property can be an excellent one and the more information you have, the more likely the results will be favorable. Affected by the economy, demand and supply, real estate is a long term investment. In most cases, it cannot be converted to cash very easily. Costs involved in buying and […]

How Earnest Are You?

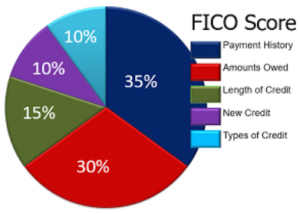

Credit Score Breakdown

Lenders use credit scores to measure a borrower’s creditworthiness. Although several different companies offer credit scores, the Fair Isaacson Corporation or FICO is the one that is most often used. FICO uses five key components to determine a borrower’s overall credit score or rating. The highest percentage, 35 percent, is judged on payment history which […]

Increase your paycheck

If you are a homeowner, your tax savings is usually realized when you file your federal income tax return once a year after you have already spent money on interest and property taxes. You may look forward to the refund as a windfall from a forced savings account. However, some people would rather get their […]

Buy Now or Wait?

It is surprising the number of people who contact a RealtorⓇ or real estate office with intentions on buying a home but they can’t qualify for a loan or don’t have a down payment. Sometimes a RealtorⓇ will begin working with a buyer who has the down payment and good credit but decides to postpone […]