Private mortgage insurance is usually required on mortgage loans for more than 80 percent loan-to-value. If a borrower defaults on their loan, mortgage insurance will reimburse the lender. You need to be aware that when certain conditions have been met, expensive PMI can be removed. When your mortgage balance has reached 80 percent of your […]

All posts by Thierry Roche

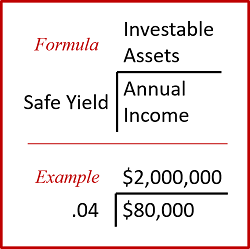

Are you ready to retire?

You would be shocked to hear just how many people have spent more time on vacation planning or mobile phone purchases than they have on planning for retirement. These same people are probably expecting that Social Security will support them through their golden years. It can be assumed that a single person who has paid […]

Risk Balancing versus Deductibles

Mortgage loan companies require a homeowner to carry insurance on their home while it has an active loan on it. The benefit is that in exchange for paying a yearly or monthly premium the homeowner transfers the risk of any loss to the insurance company. Insurance companies allow homeowners to select a deductible that will […]

Little Known Fact About Renting Your Home

Planning to attend a major sporting event but don’t have a place to stay. Think about the fact that each year there are homeowners around major sporting events that rent their homes for premium prices because there are little to no hotel rooms available. And the demand for renting private residences is up…for instance AirBnB. […]

A Good Option in FHA

A sector of the market that is not necessarily being met by other loan programs is being served by FHA insured mortgages. Buyers would love to secure a conventional 80 percent mortgage without mortgage insurance and get the lowest cost of financing possible, but if they can’t put down 20 percent then it isn’t really […]

Lighting Conversion Plan

Few of us regularly pay attention to what Congress does but in this case, you might want to. Congress passed an energy act in 2007 that set new energy-efficient standard for basic light bulbs. This act phases out standard incandescent bulbs and soon they will no longer be available. Alternative bulbs now available are LEDs […]

Holiday Travels

Your Home’s Equity Could Be the Answer

Benefits to Short Term Mortgages

Considering refinancing? Buying a new home? It maybe worth discussing a 15-year loan instead of a traditional 30-year mortgage. Monthly payments will be higher but your interest rate will be lower and your equity will climb faster. Below I have provided an example for comparison on a $300,000 mortgage with two terms. One 30-year term […]

Energy Pirates

As a homeowner, the largest expenses you will have after you pay your mortgage payment is for energy consumption. Factors that contribute to the amount you will pay are air leaks, amount of insulation, efficiency of your heating and cooling system, water heater(s) and lights. However, some of your appliances can be energy pirates when […]