“It’s a fact that many households are impacted by higher mortgage rates as they no longer earn the qualifying income for the median-priced home.” Nadia Evangelou, NAR Economist. What this means is that the rapid rise in mortgage rates during 2022 is coupled with continued appreciation of home prices. This has limited the number of […]

Tag Archives: refinance

Attention Veterans: Have You Considered An IRRRL?

How To Know If You’re Eligible For Cash-Out Refinance

It isn’t much of a secret that home appreciation has quite dramatically increased over the past two years. With that increase, most homeowners have equity. Quite often, a common way to release part of that equity is a cash-out refinance, however not all homeowners are currently eligible. First off – what is it? A cash-out […]

Cut Refinancing Expenses

Shifting Debt to Tax Deductible

Available to homeowners is the Mortgage Interest Deduction for up to $1,000,000 of acquisition debt on both their first and second home. If they have Home Equity debt they can also deduct interest on up to an additional $100,000. Home Equity Debt can be used for any purpose such as educational or medical expenses, buying […]

Save Money on Your Taxes by Bunching

Having low mortgage interest rates can be a drawback if the total interest and property taxes paid are below the amount paid for a standard deduction. If you plan a little you may be able to improve your situation at least every other year. Anyone that keeps tabs on their taxes knows that you can […]

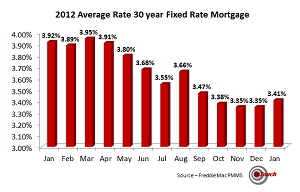

Should You Refinance?

FHA Loans and Mortgage Insurance Premium – More Expensive than Expected

Federal Housing Administration (FHA) loans can be confusing because the FHA does not make loans. It insures the loans made by lenders it has approved. So, if a lender defaults, the FHA covers the losses – not the lender.

One of the great benefits of an FHA insured loan is that it only requires a 3.5% down payment, making homeownership much more feasible for those potential buyers purchasing Fairfax VA Real Estate, who do not have the traditional 10%-20% down that conventional mortgages require.

FHA Changes – Higher Costs to You – Northern Virginia Real Estate

Pre-paid Interest on your Mortgage – What’s the Point?

If you are in process of procuring a mortgage to purchase a Fairfax, Va home, or any home for sale in Northern Virginia, it’s important to understand the tax implications of “buying down” your interest rate with pre-paid points. Pre-paid interest, sometimes called “points”, can be tax deductible when a person pays them in connection […]