We’re not talking about your “arm” – we’re talking about an adjustable-rate-mortgage. See, an adjustable-rate mortgages just simply is not the right choice for many homeowners – especially if they plan to own the home for a long time. As a stat, less than 3% of buyers choose an adjustable-rate mortgage according to NAR’s 2021 Profile of Home Buyers and Sellers. Considering that fixed-rate mortgages are hovering in the mid 4.00% range, it’s understandable that people select a rate that will not change over the term.

An arm is something to consider if buyers know they’re going to be in the home for a few years. In this case, they should at least investigate an adjustable rate mortgage. Compare the cost and evaluate the risk of an ARM instead of a fixed-rate mortgage.

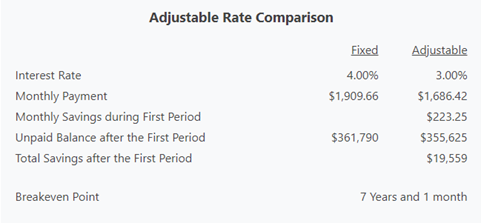

The payment on the ARM in the example is $223.25 less than that of the FRM. The rate is locked in for the initial period which is five years on a 5/1 ARM. This will save a buyer $13,395 in the first 60 months.

An obvious advantage to create savings is the lower interest rate for the initial period – but another dynamic that takes place is that lower interest rate loans amortize faster than higher interest rate loans. In the example shown, the unpaid balance on the ARM is $6,165 less than the fixed-rate mortgage creating a total savings of close to $20,000 for the ARM in the first five year period.

If you take a look at that chart, you’ll see that the comparison estimates the breakeven point on this example to be 7 years and 1 months. That is when the savings during the initial period will be exhausted based on interest rate adjusting the maximum allowed at each succeeding period. This is a worst-case scenario because ARMs are adjusted according to an independent index that the lender has no control. The payment can adjust downward just as it can adjust upward.

You could save money. Even if you know you are not going to be in a home five years or less, you might just choose a fixed-rate mortgage. With the difference in rates being so close, some people might think the fixed rate is safer in case their plans change and they end up living in the home a longer period. Still, for the person who feels comfortable with the uncertainty of changing payment, the ARM may save them money.

For an estimate of what it could save you based on your price range, use this ARM Comparison and you can see the current FreddieMac rates on fixed and adjustable loans. Call me at (703) 303-4010 for a recommendation of a trusted mortgage professional.