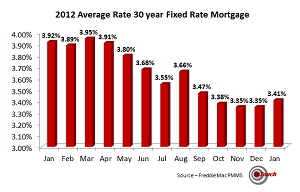

Homeowners, excited about lowering their mortgage rate by refinancing, have a tendency to ignore the costs because they are rolled into their new mortgage. If there’s no money out of pocket and the payment is lower than what they’re paying, it often seems like a good deal.

All posts by Thierry Roche

Shifting Debt to Tax Deductible

Available to homeowners is the Mortgage Interest Deduction for up to $1,000,000 of acquisition debt on both their first and second home. If they have Home Equity debt they can also deduct interest on up to an additional $100,000. Home Equity Debt can be used for any purpose such as educational or medical expenses, buying […]

When to Sell the Temporary Rental

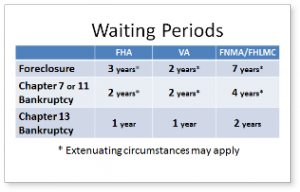

Boomerang Buyers

Save Money on Your Taxes by Bunching

Having low mortgage interest rates can be a drawback if the total interest and property taxes paid are below the amount paid for a standard deduction. If you plan a little you may be able to improve your situation at least every other year. Anyone that keeps tabs on their taxes knows that you can […]

Remove FHA Mortgage Insurance Premium

Prepare To Stay Comfortable

Home Mortgage Interest Deduction

Thoughts and choices If you are trying to decide to take standard tax deduction or itemize when filing your income tax return, you need to look at what gives you the highest return. Most people that make over $75,000 a year itemize their deductions, but with lower interest rates is this wise? For […]