Some buyers are under the impression that they need to wait until they have saved a 20% down payment so when they buy their dream home they can avoid mortgage insurance (PMI) which lenders required when the loan-to-value ratio of larger than 80 percent. The only exception to this rule is VA loans.

Some buyers are under the impression that they need to wait until they have saved a 20% down payment so when they buy their dream home they can avoid mortgage insurance (PMI) which lenders required when the loan-to-value ratio of larger than 80 percent. The only exception to this rule is VA loans.

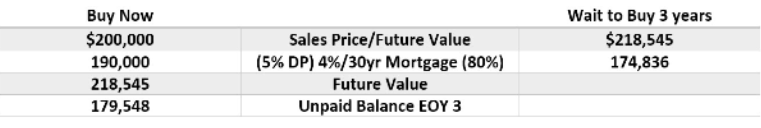

Here is a typical example. Let us assume that a buyer has saved $10,000 for a down payment and is interested in a $200,000 home. Their choice is to purchase now using a 95 percent loan or purchase later once they save up another $30,000 down payment so they get an 80 percent loan without PMI.

Problem is it may take that buyer 3 years to save up the additional down payment but by then the $200,000 home has appreciated to at least $218,545 if we assume 3 percent appreciation and that is conservative. Then a 20 percent down payment on the increased sales price would be $43,709 less the $10,000 already saved or $33,709 or $936.36 per month. More bad news, they would have to get a mortgage loan at the rates available 3 years from now which will most probably be higher.

A workable alternative is not to wait but purchase the home now with the 95 percent loan and our low interest rates and pay the $85 per month for PMI, which depends on your credit score. Then by the end of the above 3 years, your unpaid balance would be $179,548. If we apply the same appreciation of 3 percent and assume the home value to jump to $218,545, your equity would be $39,000. If you want to reduce this mortgage to the same amount worked above then you could make an additional principal payment of $125 per month thus giving you an unpaid balance in 3 years of $174,775.

Once the equity balance for the home rises to the 80 percent loan-to-value target, PMI can be requested to be dropped. This might require a current appraisal for proof but the money you save in interest rate should make up for that. In a few situations, refinancing the loan balance may be required to drop the PMI. Check with your lender when asking about mortgage products to see what their requirements are for PMI. Make sure they know you want to drop it as soon as it is no longer required. Make a note in advance on your calendar if the lender requires a request in writing.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!