Retirement Planning – an activity that we often procrastinate in doing although it is very important. A lot of people plan to have their home mortgage paid off by a magical date so they don’t have to make payments after they retire. It makes a lot of sense to try to eliminate large recurring payments before you stop working.

Retirement Planning – an activity that we often procrastinate in doing although it is very important. A lot of people plan to have their home mortgage paid off by a magical date so they don’t have to make payments after they retire. It makes a lot of sense to try to eliminate large recurring payments before you stop working.

A common strategy is making additional principal payments when you make the regular monthly payment to reduce not only the principal you owe but the interest owed on that principal and hopefully pay off the mortgage by your target retirement date.

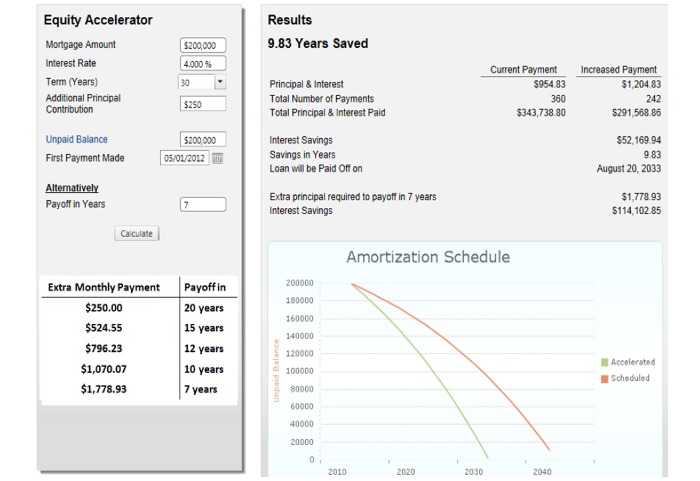

An example would be if you refinanced your $200K mortgage at a 4 percent rate last year, first payment due on May 1st 2012. With a normal amortization schedule, in this example, you would have the home paid off at the end of the 30 year term.

You can accelerate the payoff by making additional principal payments detailed below.

- Add $250.00 a month = mortgage paid in 20 years

- Add $524.55 a month = mortgage paid in 15 years

- Add $796.23 a month = mortgage paid in 12 years

An obvious benefit to you is having your home mortgage paid off at retirement, thus no burdening large monthly payment. It also creates a substantial asset that you can borrow against or sell should the need arise. We do have mature clients with Fairfax homes for sale who are following their retirement planning and making that move into their smaller home.

A second strategy would involve you purchasing a smaller home as a rental investment property that you can later live in after retirement. Using some of my real estate secrets, we could review the Fairfax homes for sale and get you into real estate investing rather quickly.

I have provided the Equity Accelerator graphic below to help you with projections for paying off your home mortgage. The graphic on the left shows the example we talked about and will help you calculate how much extra principal payment you need to make depending on number of years to pay off. The graphic on the right shows the results in detail.