We all remember what happened in late 2007 and early 2008 with the real estate market. The bottom dropped out of it and sent our economy into turmoil helped by bad lending practices across several mortgage companies.

We all remember what happened in late 2007 and early 2008 with the real estate market. The bottom dropped out of it and sent our economy into turmoil helped by bad lending practices across several mortgage companies.

As a result, the Dodd Frank Reform Act was enacted to help protect the home buyer from predatory lending practices. Part of that act, the QM or Qualified Mortgage Rule went into effect January 14, 2014. This Act, strengthens the standards used for underwriting mortgage loans and qualifying buyers.

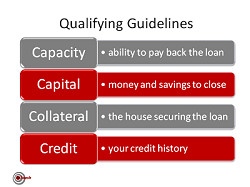

Financial information is required from the buyer and the lender must be able to verify it. The lender must determine if the borrower has sufficient off-setting assets and/or has the income to pay the loan back. The max debt-to-income ratio is set to 43%. The removal of teaser rates advertising, which could hide true mortgage costs, has been initiated.

Some limits that have been put into effect are limiting the payment of upfront fees and points to 3 percent to benefit the borrower. Also, negative amortization, balloon payments or interest only payment options have been removed. Mortgage loan term limits now have a max of 30 years.

This is a clear attempt to bring good standard underwriting practices back into mortgage lending across the board. It also forces the lenders to consider the borrower more carefully and to spend the time to verify their income, employment status, assets, debt, other current loans, any child support or alimony payments and their current credit history.

If you are currently in the market to purchase a home, I can set you up with a list of Fairfax homes for sale and get you suggested reputable mortgage lenders with which you can become pre-qualified. A pre-qualified buyer is a bonus for home sellers since they have already jumped through the hoops with a lender. Home sellers are more apt to accept offers from pre-qualified buyers.