Two main benefits to owning rental real estate is gaining appreciation on your investment and the tax savings to you at the end of the year. But what if we didn’t consider these benefits, would owning rental real estate still be a good idea?

Two main benefits to owning rental real estate is gaining appreciation on your investment and the tax savings to you at the end of the year. But what if we didn’t consider these benefits, would owning rental real estate still be a good idea?

Let’s look over a couple of other conservative measurements. Knowing about these other benefits that accrue with your investment might help you decide.

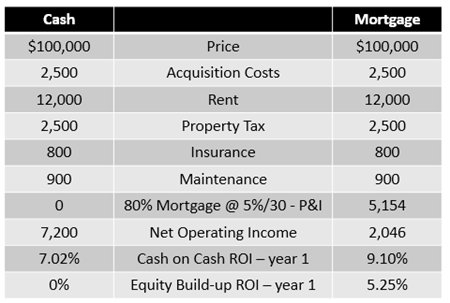

Let’s say you bought a home and paid cash. Then over the next year you collected the rent and paid your expenses. Any leftover cash is your Net Operating Income. I have provided a graphic example below that shows your investment would create $7,200 a year. This results in a 7.02 percent cash on cash rate of return. This is much higher than the current 10 year treasury bond rate of about 2.3 percent.

Now, if you were to buy that same home with a mortgage, your return rate increases because it is leveraged. After paying your principal and interest, net operating income will decrease but your cash on cash return rate will increase to 9.10 percent because your down payment or initial investment was less.

Another measurement of your return rate is the increase of the home’s equity which happens after every monthly payment you make since the mortgage is amortized. In my example below, equity build-up divided by the initial investment yields a 5.25 percent return rate within the first year. Still better than the 10 year treasury bond.

Investing in a single family home for rental purposes offers you, the investor, an opportunity to earn higher than normal return rates. Plus you get tax benefits, an appreciating asset and more control over the asset. Call if you’d like to talk about what kind of rental opportunities are available within Fairfax homes for sale.