As consumers, we are always looking for the latest deal. We are often lured by the zero percent financing gimmicks thrown out there by car salesman and retail stores. At zero percent, it doesn’t cost you anything to use their money. But mortgage rates do not offer zero percent. With the average 30-year mortgage rate hovering below 4% nationally, they are close enough to consider it the same deal.

As consumers, we are always looking for the latest deal. We are often lured by the zero percent financing gimmicks thrown out there by car salesman and retail stores. At zero percent, it doesn’t cost you anything to use their money. But mortgage rates do not offer zero percent. With the average 30-year mortgage rate hovering below 4% nationally, they are close enough to consider it the same deal.

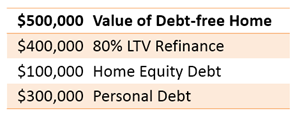

As a homeowner, you can deduct qualified mortgage interest on your tax return subject to the max of $1 million in acquisition debt. But if you have a home that is paid off, your initial acquisition debt is zero and you can only deduct interest on a home equity loan max of $100K.

So if you are going to have to pay interest, wouldn’t it be better to pay a lower interest rate that is tax deductible?

Consider my example. If a taxpayer with a $500K debt-free home took an 80 percent equity cash-out refinance of $400K, only $100K of that would qualify as home equity debt and be deductible on their tax return. The other $300K is not tax deductible because it would be considered personal debt.

So the key is to borrow the money based on your need or reason. With the rates so low, the loss of tax deduction of interest on the $300K is not as bad as if the rates were higher.

With the borrowed money, you can pay off student loans, higher debt credit cards, or even accrued business debt where the interest rates may hover around 20 percent (and are not deductible at all). By refinancing a home and paying off these higher interest items, you will save money on interest you would have paid way above the average of 3.8 percent currently available. With the latest news that the Fed will be keeping interest rates low this year, this is good for you!

As always, I suggest you contact your accountant or tax adviser for details on how paying off your debts will benefit you.

Looking for Fairfax homes for sale? I can send you a current list matched to your specified parameters. Need to be near a certain school, or near shopping and restaurants, or close to work? I can help!