There are several types of investment opportunities in the world today. If you take a certificate of deposit, this generates cash flow depending on its interest rate but that is the only way it generates investor returns.

There are several types of investment opportunities in the world today. If you take a certificate of deposit, this generates cash flow depending on its interest rate but that is the only way it generates investor returns.

If you invest in stocks, and don’t get paid dividends, you only earn your investment back if you sell the stock higher that what you originally paid for it. On the other hand, if your stock does pay dividends, you could make a profit from it even if you sell it at the original price.

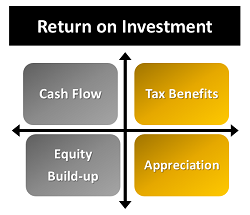

Now, here are 4 ways you can profit from investing in rental real estate.

- After you collect rent and pay your expenses, the resulting surplus creates a cash flow for you.

- You will build equity monthly just by paying down the mortgage on the property. Turn surplus cash into principal payments and build equity even faster.

- You will gain tax benefits by claiming depreciation allowed on rental property and the preferential long-term capital gains tax rate.

- Real estate market appreciation always benefits you as an investor when the value of your rental property increases. Thus supporting a future sale to fund your retirement or other opportunity.

A conservative real estate investor makes a decision on purchasing property as rental property by considering the probability of cash flow and ability to reduce the outstanding mortgage through monthly payments. If the monthly surplus benefits the investor with a nice rate of return, adding in the possible appreciation and the tax benefits become a bonus.

With Fairfax homes for sale inventory low and rental prices increasing due to demand, a investor with a low mortgage rate can get a decent high return on rental property investment over other alternatives. Contact me for more information- (703) 303-4010; you may be amazed about what is available in today’s market.