Don’t lose your ability to deduct mortgage interest from your taxes by not properly handling the mortgage loan paperwork when taking money from a relative to buy a home. Especially if you might become their heir. Home mortgage interest can only be deducted if the loan you accept is a secured debt and you sign […]

Category Archives: Loans

Make it Your Principal Thing

Most American believe that they will have a car payment and a house payment for the rest of their lives. But if you get a plan and a little discipline you don’t have to be in that majority. You plan should be to make additional principal contributions to your fixed-rate mortgage which will shorten the […]

The Cost of Co-Signing

You may have been approached by a family member or friend to co-sign a loan for them. Assurances are made that they will make payments. You feel obliged because you don’t want to disappoint them. It won’t cost you anything…or will it? When we change our thinking about the loan it might make more sense. […]

Things that affect your credit rating

Are you one of the people who don’t really care about your credit rating until you need it for a loan? If so, you are taking a chance on being denied future loans and/or delaying any decisions on financing. A common issue is not reviewing and correcting items recorded on your credit report. There are […]

Federal Housing Administration & Veterans Administration Mortgage Assumptions

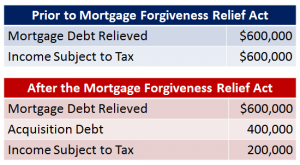

Debt Relief = Income

Remove FHA Mortgage Insurance Premium

FHA Loans and Mortgage Insurance Premium – More Expensive than Expected

Federal Housing Administration (FHA) loans can be confusing because the FHA does not make loans. It insures the loans made by lenders it has approved. So, if a lender defaults, the FHA covers the losses – not the lender.

One of the great benefits of an FHA insured loan is that it only requires a 3.5% down payment, making homeownership much more feasible for those potential buyers purchasing Fairfax VA Real Estate, who do not have the traditional 10%-20% down that conventional mortgages require.