As a homeowner, you usually get your tax savings or refund after you file your tax return in the following year. You are able to deduct what you spent on loan interest and property taxes. Some of us look forward to that big refund check, but some of us need the extra money during the […]

All posts by Thierry Roche

How to hire an Realtor®

Selling a home is a serious and major undertaking in your life. So shouldn’t your Realtor® be just as serious about representing you? If you are new to this process or just haven’t sold a home in a while, the answers you get to the questions below can show you revelations about your Realtors’ experience […]

Chill…There’s an Alternative

Save Interest, Build Equity & Shorten the Term

Investing in savings accounts today will earn you back less than one percent on your money and you will be required to pay income tax on those earnings. But if you contribute something extra to your mortgage each month, you will earn savings in a more beneficial way. Paying additional principal payments on your home […]

Can I Make Money on my Home?

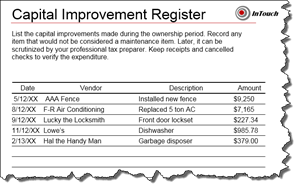

As a homeowner, you may often wonder if spending money on repairs or improvements for your home will net you any return. If you spend money on capital improvements, then you raise the base cost of your home. When you sell your home, these capital improvements can lower your capital gain and save you taxes. […]

Can you afford to pass on this opportunity?

Are You Ready for This?

A short story about an offer presented to a single, senior woman who was relocating to a retirement home: The offer was for full price and had reasonable terms and timelines. The seller would not accept it. As the offering agent delved deeper into why, the agent discovered the seller was upset about her dining […]

Home for Sale? Secure It!

During the month of September, REALTORS® draw special attention to securing any homes that they have on the market for sale. September has been designated REALTOR® Safety month. But safety is also the seller’s responsibility so here are some tips to keeping your home secure and lessening any risk. Locks – your windows and doors […]

It’s a Pain in our Derriere but Someone has to do it.

As a homeowner, you expect the major systems and components in your home to function correctly and continuously. To accomplish this, periodic maintenance becomes just as important as having a trusted handyman who can make major repairs. Letting things go just invites Murphy’s Law into your home causing your a/c to wait until its very […]

Agent Sets Northern VA Record with 262 People in One Open House – Home Sells in One Day

Thierry Roche of Keller Williams Realty and Host of Talk Radio’s, Inside Real Estate often educates the public as well as his own clients on the Highest return Marketing tactics that produce the highest prices for his seller clients or anyone else with the ability and resources that is willing to employ his unique marketing […]