As a homeowner, you may often wonder if spending money on repairs or improvements for your home will net you any return. If you spend money on capital improvements, then you raise the base cost of your home. When you sell your home, these capital improvements can lower your capital gain and save you taxes.

As a homeowner, you may often wonder if spending money on repairs or improvements for your home will net you any return. If you spend money on capital improvements, then you raise the base cost of your home. When you sell your home, these capital improvements can lower your capital gain and save you taxes.

Any capital improvements have to prolong the useful life of your home and add value to the home. Routine repairs are made to maintain the current value of the home and keep it in good operating condition.

If you add a pool, deck, fencing or landscaping, these add value to your home. The same goes for replacing carpeting or adding tile, or updating counter tops. Big ticket items like replacing your roof, buying appliances, or having the HVAC system replaced are considered extending the useful life of your home. An example of adapting a part of your home to a new use would be finishing an unfinished basement or converting a garage to living space.

Items outside your home that can raise your home’s base value would be any special assessments you paid through taxes for adding sidewalks, paving roads, or adding curbs to your neighborhood. Other items include any money you spent to restore casualty loss damage due to storms or water that was not covered by your insurance policy.

Follow this suggestion on how you might save money in the future:

Each time you buy something for your home, other than your mortgage payment and utilities, put your cancelled check or receipt in a special folder called “Home Improvements.” Don’t worry right now how the expense is classified – just dump it in the folder.

Then in the future, once you sell your home and tax time comes around and it’s time to report that profit you made on the home, turn that folder labeled “Home Improvements” over to your tax advisor and let them determine which of those expenses will be considered adjustments to your base value.

With an uncertain future for tax deductions and exclusions on principal residences, the record of these receipts may save you money. Having proof of those expenditures will be important. Capital gains tax could increase. Whichever the case, be prepared with your records to cover any outcome.

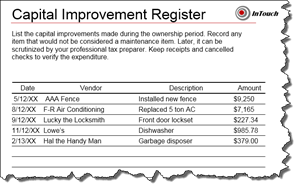

Create an Improvement Register or read more in IRS Publication 523 on Increases to Basis. Homeowners with Fairfax homes for sale are getting advice on how capital gains will affect the sale of their home. Don’t be left out in the cold. Contact me today if you need assistance.