The Golden Rule of Personal Finance is to pay yourself first.

The Golden Rule of Personal Finance is to pay yourself first.

The idea being that the first check you write out each month is to your savings account. The thought behind this is if you wait until the end of the month there won’t be any money left to contribute to your savings or investment accounts for the month.

By making it a priority to save first, it forces you to realize that the balance of your money for the month must pay your bills, living expenses and any discretionary spending. This is a different and more beneficial strategy than saving what is left over at the end of the month. Chances are there will be nothing left. It is often too easy to say “I’ll save double next month.”

If you buy or own a home, financial experts say you are already in a forced savings account because a portion of your monthly house payment is used to reduce the principle on the loan. Some homeowners use this “forced savings” by getting a shorter term mortgage and building their equity faster.

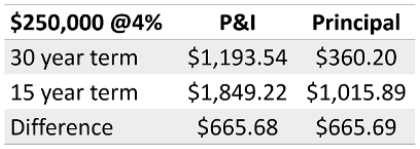

Provided below is an example that might help you envision the concept being discussed. Let’s assume a $250,000 mortgage at 4 percent interest and compare two different terms. Choosing a 30-year mortgage will give you payments of $1,193.54 per month and $360.20 from your first payment will be applied to the principle. With each payment the amount applied to principle would steadily increase.

Choosing a 15-year mortgage will give you payments of $1,849.22 per month and $1,015.89 of your first payment would be applied toward the principle. The additional $665.68 applied toward reducing the loan acts as a forced savings account.

As a homeowner with a longer term mortgage, you might have every good intention of saving the extra money or making additional principal payments each month but stuff happens. After the bills are paid we don’t always have the extra money to put into savings.

Opting for a shorter mortgage forces the borrower into making the commitment of the higher payments each month which in turn reduces your principal balance faster. Thus, a forced savings account.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or get a FREE Listingbook Account so you can Search All Northern Virginia Homes For Sale just like a Realtor. Put that data you need at the tips of your fingers!