As a homeowner, you usually get your tax savings or refund after you file your tax return in the following year. You are able to deduct what you spent on loan interest and property taxes. Some of us look forward to that big refund check, but some of us need the extra money during the year.

As a homeowner, you usually get your tax savings or refund after you file your tax return in the following year. You are able to deduct what you spent on loan interest and property taxes. Some of us look forward to that big refund check, but some of us need the extra money during the year.

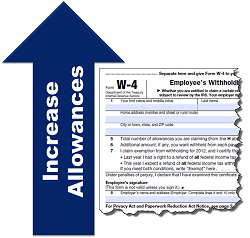

One possibility is to adjust your withholdings on your W-4 form with your employer. This will give the homeowner more money during the year instead of waiting for the refund check at the end of the year. Talk with your employer about increasing your deductions from what you originally stated on your W-4.

With an increase in your exemptions/deductions, you will have more take home pay each paycheck. But if you add too many exemptions, you may end up underpaying your taxes and incur interest or penalty and have to pay additional tax when filing your return.

I would encourage all potential home buyers considering a strategy like this to seek the advice of your tax professional, or check in with human resources at work. These professionals can guide you on taxes and deductions.

Homeowners with Fairfax homes for sale can get additional information about W-4 forms from the Internal Revenue Service on their website.