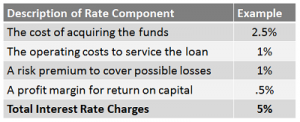

As a business, mortgage lenders are in it to make a profit. Their costs include operating costs and cost to them to acquire the borrowed funds. Profit margins expected from these businesses are easily identified. The only variable in this business is the credit worthiness of you, the borrower and the type of mortgage you can obtain.

As a business, mortgage lenders are in it to make a profit. Their costs include operating costs and cost to them to acquire the borrowed funds. Profit margins expected from these businesses are easily identified. The only variable in this business is the credit worthiness of you, the borrower and the type of mortgage you can obtain.

To a lender, giving out a loan with only a 3.5 percent down payment is riskier to them than a loan with a 20 percent down payment. On a loan with a smaller down payment, if the property reverts back to the lender, on an 80 percent mortgage, the difference between the worth of the property and what is owed is greater. Any lender is looking to reduce the risk to their company when lending money.

Using “credit scoring,” a lender can allow competition for borrowers to get the best loans based on this risk-based price method. Now, each lender can set their own definition of what an “A” credit score means. For example, if good credit is considered 710 and above, borrowers rated below that score are considered a higher risk and their loans rates will be higher.

Risk is assessed based on the market value of the property used for collateral and the buyer’s credit score. Lenders will scour your credit history and your income history to determine stability. If a default occurs, the property value must be high enough to secure the loan and not create a loss for the lender.

Now, your challenge is to know what your credit score is before you apply for a loan and know how it will affect your borrowing power. It will be to your advantage to get pre-approved for a mortgage loan before beginning your search for Fairfax homes for sale. This also gives you a price level at which you can search for a home. There are a few cases where a lender can help you improve your credit score by giving you good advice and in turn, help you qualify for a lower interest rate.

Contact me for a recommendation of a trusted mortgage professional – Thierry@ThierryRoche.com.