Stability, affordability and flexibility are the three best reasons why homebuyers often choose a 30 year mortgage over a 15 year mortgage. But if you can afford to make a higher monthly payment, here are three great reasons to choose the 15 year mortgage: build equity faster, save on total interest and pay off your mortgage faster.

Stability, affordability and flexibility are the three best reasons why homebuyers often choose a 30 year mortgage over a 15 year mortgage. But if you can afford to make a higher monthly payment, here are three great reasons to choose the 15 year mortgage: build equity faster, save on total interest and pay off your mortgage faster.

A first-time home buyer will tend to choose the 30 year mortgage because they are concerned with making affordable monthly payments and with their down payment amount.

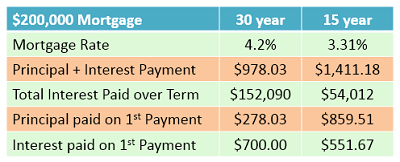

But let’s look at some numbers. Take a $200,000 mortgage at a 30 year term and a 15 year term using mortgage rates of 4.3% and 3.31% respectively. Although your monthly payment for the 30 year term is $433.15 less you are typically charged a higher interest rate. Your total interest paid on the 30 year term, once is it retired, will be about three times more than the 15 year term. See my quick chart below for some comparisons.

If you decide on a 15 year term mortgage, a nice benefit is that more of your payment will go to pay on the principal each month from the beginning. For a 30 year term it would take you over 13 years to exceed your interest payment.

Now you might hear suggestions on taking a 30 year mortgage but then making payments like you had a 15 year mortgage. Doing this would definitely accelerate your amortization and save you interest on the loan. But you must be disciplined enough to keep it up. Some may say, “Oh I will double up next month” or “I just can’t add that extra payment this month.” Avoid these pitfalls by getting the 15 year term loan in the beginning. The best benefit to buying a home is the forced “savings” that you are getting through amortization over what you would not get if you were renting.

If you are ready to buy a home, I can provide you a list of Fairfax homes for sale that match your criteria and advise you on which of these would work best for a 15 year mortgage. Call me today to get started!