As interest rates increase, the group of people who can afford to buy a home decreases just a little. New mortgage rules have gone into effect this year which tightens the payment to income ratios. As our summer demand season approaches, experts are predicting interest rates will rise.

As interest rates increase, the group of people who can afford to buy a home decreases just a little. New mortgage rules have gone into effect this year which tightens the payment to income ratios. As our summer demand season approaches, experts are predicting interest rates will rise.

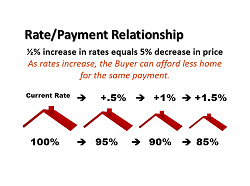

A half percent rise in interest rate roughly translates to a five percent increase in price. To demonstrate my statement, let’s explore some math.

- Finance 100 percent of a $250K home, 4.5 percent interest, 30 year term, payments are around $1,266.71 a month.

- Mortgage rate increases to five percent, your monthly payment becomes $1,342.05.

- Increase the home value by five percent to $262,250, 4.5 percent interest, payments are around $1,330.05.

The difference in the amounts of these two payments is so little that it justifies saying that a half percent change in interest rates is about equal to a five percent change in price.

Home prices are rising. NAR has reported a rise of 11 percent just last year. Mortgage rates are rising. A buyer who would qualify to buy a home now, might not qualify in six months. Don’t be that buyer who, down the road, regrets not taking the plunge today. Let me send you a list of Fairfax homes for sale and help you get into a home now while rates are still down and prices are reasonable. Call me today at (703) 303-4010.