Want to go shopping? Have you ever thought about shopping for a lower mortgage rate? If not, you may want to consider it. If you decide to go shopping for a lower mortgage rate, one thing you do need to consider is that not all lenders share the same business practices. Some of them may […]

Tag Archives: mortgage refinancing

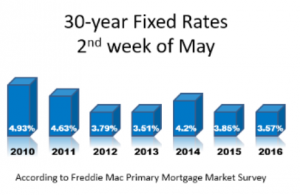

It Might Not Be A Good Decision To Wait For Mortgage Rates To Come Down

Why APRs Are Higher Than Interest Rates

We should probably start this with “what exactly is an APR?”. An APR is an “Annual Percentage Rate”, and is a calculation to accurately reflect the cost of the mortgage considering the note rate of interest, financing fees and charges based on the term of the mortgage. APR calculates the interest rate and loan fees […]

Understanding the Mortgage Interest Deduction When You Refinance

In 1913, the 16th amendment allowed personal income tax and one of the allowable deductions was mortgage interest paid on your principal residence. A follow up in 2017, Tax Cut and Jobs Act reduced the maximum amount of acquisition debt to $750,000 from $1,000,000. Acquisition debt is the amount of debt used to buy, build […]

Are you one of the 7 out of 50 that will save money

Of 50 million homeowners it is estimated that 7 million of them could save money each month if they refinanced their existing mortgage. One obvious saving is refinancing at a lower mortgage rate. Another saving is that if you bought a home before 2011 and your are paying for mortgage insurance, you might want to […]