Most American believe that they will have a car payment and a house payment for the rest of their lives. But if you get a plan and a little discipline you don’t have to be in that majority. You plan should be to make additional principal contributions to your fixed-rate mortgage which will shorten the term and save you thousands of interest.

Most American believe that they will have a car payment and a house payment for the rest of their lives. But if you get a plan and a little discipline you don’t have to be in that majority. You plan should be to make additional principal contributions to your fixed-rate mortgage which will shorten the term and save you thousands of interest.

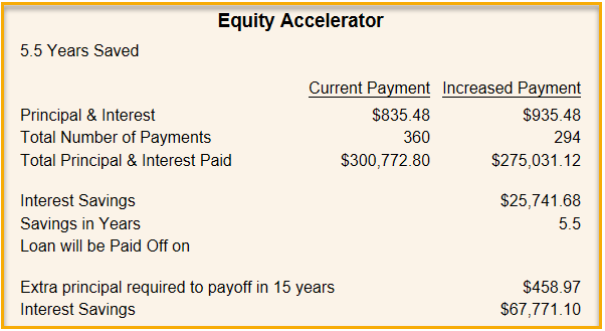

If you just pay an additional $100 every month on your loan principal, and let’s use $175,000 as a mortgage amount, you will shorten the mortgage term by five or six years! If you pay $200 every month on your loan principal, it will shorten by 9 years. An additional $459 shortens it to 15 years. Wow! Talk about saving money in a big way!

Note, if you are going to make additional principal payments be sure to select the right choice and/or call your lender to find out how to make these payments so they are applied to the principal and not adding into your escrow account.

Savings accounts today pay about 0.5 percent or less. Even if you have a low mortgage rate, you will still save yourself a considerable amount by knocking down that principal. Remember lower principal means lower interest charged on the balance of the mortgage. And if in the future you need to take an equity loan for some reason, there will be more equity available to you.

Make your own projections using the Equity Accelerator example below.

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!