An available solution for helping buyers and sellers is this uncommon mortgage program.

An available solution for helping buyers and sellers is this uncommon mortgage program.

Called a temporary buy down, it is a fixed mortgage in which to seller prepays the interest at closing i order to lower the payments for several years. The borrower must be approved at the note rate however, but will get the benefit of having lower payments in the beginning of their mortgage.

A common buy down program is a 2/1 where the first year’s payment rate is 2 percent lower than the note rate and the second year moves up to 1 percent lower than the note rate. The third year of payments would then be at note rate.

Here is an example. A buyer is using their cash for a down payment and closing costs to buy a home. They would like to make improvements to the home after purchase but will be unable to for several years since they used their cash.

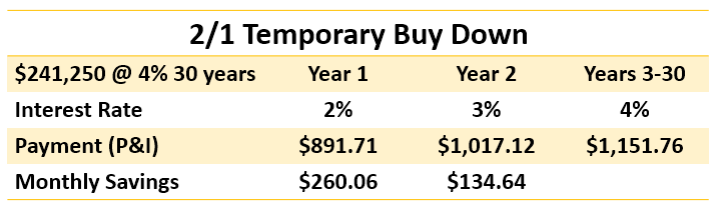

So we have a $250,000 home bought with a 3.5 percent down payment and a 4 percent 30 year mortgage. Under normal conditions, the principal and interest (P&I) payment would be $1,515.76 for all 30 years. As an incentive, the seller can pay the lender $4,736 at closing and it can be applied to the prepaid portion of the interest for the first two years.

In the first mortgage year, the buyer’s P&I will be $891.71 at 2 percent interest rate which is 2 percent lower than a 4 percent note rate. This works out to $260.06 lower per month. The second year payments are based on a 3 percent interest rate so the monthly payment will be $1,017.12 which is 1 percent lower than the 4 percent note rate. This is $134.64 lower per month.

Another incentive and bonus to the buyer is that the prepaid interest is then deductible by the buyer on their taxes in the year they purchase the home. The buyer will be lower payments for the first two years and a larger tax deduction in the first year after purchase.

Using this 2/1 buy down program would be a great selling point for a home seller who wants to offer and incentive and increase the marketability of their home without lowering the price. It might be a challenge to explain it to agents and buyers who are not familiar with this program. As a RealtorⓇ, we can discuss whether or not this is a good solution for you. Contact me today!

Want some Insider Information on Fairfax VA homes for sale? Get a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!