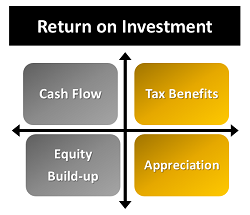

There are several types of investment opportunities in the world today. If you take a certificate of deposit, this generates cash flow depending on its interest rate but that is the only way it generates investor returns. If you invest in stocks, and don’t get paid dividends, you only earn your investment back if you […]

Category Archives: Tax Deductions

Time to Review your Personal Finances

The average worker has to earn two dollars for every dollar they want to spend assuming they are paying 50 percent of their earnings in social security, income tax and Medicare tax. By reducing your personal expenses, you get back 100 percent of that money because it is usually spent after taxes. A new year […]

Where Is Your Retirement or Savings Invested?

If you have saved for a rainy day or for your retirement, first Congratulations! But wait…where did you invest it? If you are like over twenty-five percent of Americans you have it in cash or in a savings account instead of in bonds, stocks or real estate. It is understandable why you would want to […]

Shifting Debt to Tax Deductible

Available to homeowners is the Mortgage Interest Deduction for up to $1,000,000 of acquisition debt on both their first and second home. If they have Home Equity debt they can also deduct interest on up to an additional $100,000. Home Equity Debt can be used for any purpose such as educational or medical expenses, buying […]