Here’s the question … are you better off, from a financial standpoint, renting or owning your home?

Normally, renting a home does have some advantages. It’s a short-term commitment, and your landlord is responsible for all repairs.

In most cases nowadays, owning a home can actually mean that your monthly payment would be lower than your rent … especially with today’s low mortgage rates. If you do own, you are responsible for repairs and possibly even a homeowner’s association fee (HOA).

One of the initial benefits is the ability to deduct your property taxes as well as your qualified interest on the mortgage. Believe it or not, with the increase of the standard deduction and a limit of $10,000 on state and local taxes, it’s estimated that 90% of homeowners do not itemize their deductions to consider property tax and mortgage interest. Considering that, this comparison does not consider them.

Two very significant benefits which contribute to a home being an excellent investment are principal reduction due to normal amortization of the mortgage and appreciation of the property. The owner’s equity grows while the property goes up in value, as well as while the unpaid balance decreases … which increases their net worth.

If you rent, you do not benefit from either of these … but your landlord does! That’s the reason that you’ll hear the saying “whether you rent or buy, you pay for the house you occupy”. Think about that statement for a moment … you are paying for the home of your landlord.

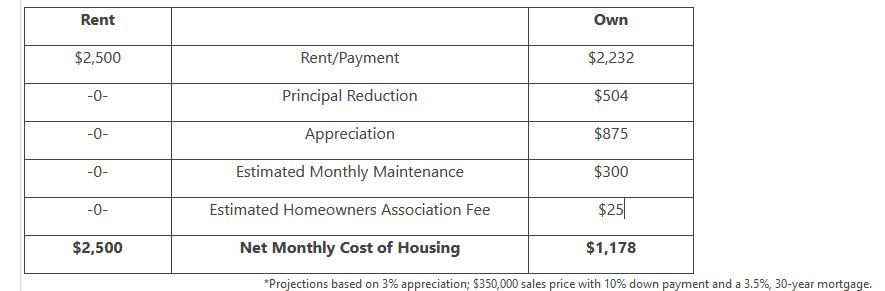

In the chart above, you’ll notice that with each payment made on a fully amortized loan, the principal balance is reduced. While appreciation is generally expressed in an annual rate, homes go up in value incrementally throughout the year so considering the monthly appreciation is appropriate in this comparison.

In this example, the payment is less than the rent proving the initial idea that it costs less to own a home. Once you factor in the effect of the principal reduction and the appreciation, and even when you consider the maintenance and HOA fees, the net monthly cost of housing is considerably less than renting.

The equity of the home is the largest part of the savings, which directly impacts a homeowner’s net worth. While the money may not be easily accessed, it has real value and available in a cash-out refinance or when the home is sold.

If you curious about how your numbers would be reflected in a similar comparison, reach out and we will discuss it together!

I can provide Insider Information on Fairfax VA homes for sale. Get you a FREE Market Snapshot Report of Your Northern Virginia Home’s Value, or Search All Northern Virginia Homes For Sale. Put that data you need at the tips of your fingers!